Investing is an essential component of modern life. Saving money for the future allows us to thrive long after we stop earning an income. But before we even invest our money: what is a good investment?

In Part I of the Investing Series, we discussed what investing is, and why investing is a big part of your life. We also explored the major goal of investing, which is to triumph over entropy and inflation.

Today, we’ll focus on how you can determine if an investment is good or bad.

Investors always have individual goals. What I invest in and what I want to get out of my investments will be totally different to you. But the underlying reason we all invest in anything is to protect our health and wealth in the future.

You may want to achieve a specific return or use your money for a good cause, but the base goal remains the same:

Make the future easier by making money go further in a time where we need it most.

Welcome back to the Investing Series – my thoughts on risk, asset classes, and how to select investments that are right for you.

By the end of this article I hope to leave you with the following:

- You can name several asset classes (ways to invest your money);

- You understand risk vs reward, and how to apply it to investing; and

- You can determine whether or not an investment is a good choice for you.

Investments Revisited

As we defined previously, investing is the “commitment of time, money, or energy in hopes of receiving a specific, greater output”.

Put simply, investing your money means buying something and hoping it’s worth more money when you sell it. The aim is to buy things that you believe the world will value more than the money you used to pay for it, when accounting for inflation.

If that sounds very difficult to achieve, it’s because it is.

Nobody can pick a single investment and expect to make a massive return from it. Most people that claim they can do that are scam artists. Some are politicians.

Not every investment will do well. Some may slowly lose value over time. Others can collapse entirely overnight. Market forces, international politics and bad luck can all influence your investment outcomes.

But as we discussed previously, everything you do is an investment. Investing in your wealth and your health is a constant, ongoing goal.

Risk vs Reward

Investing does not guarantee any output, or reward. And every investment comes with some degree of risk.

So what are risk and reward, and why is understanding them essential to investing?

Understanding Risk vs Reward

Risk is the chance of something bad happening. If you’re putting your money into a particular investment, you risk losing some or all of your money. If you’re investing time into learning a new skill, you risk not enjoying it or just not getting better at the skill. Investing time into getting to know someone before asking them on a date? You risk that relationship not going anywhere.

That all sounds quite bad, so why bother investing at all? We invest for the chance of a reward.

A reward is a benefit of some kind; something good happening. Suppose we take the investments made above. You may be rewarded for a monetary investment by the value of your investment going up. This allows you to sell for a profit and then use that money for something else. The reward for dedicating yourself to learning a skill could be a sense of enjoyment & accomplishment, or opportunities to work with new people or make money. Your reward for spending time with people is often the company itself, and investing in the right person could reward you for the rest of your life.

The Balance

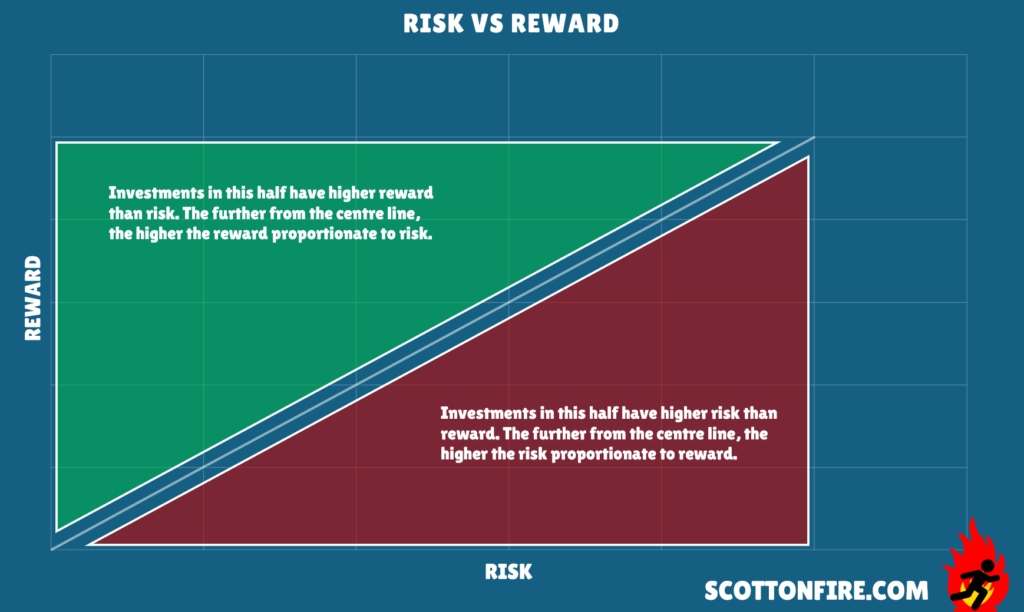

One of the most important elements to investing is understanding the balance between risk and reward. Below is an example of how you can compare the two to determine if an investment is a good choice for you.

This graph shows that as risk increases, so too does the reward. For this example, both increase at the same rate.1

In practice, your risk-reward spectrum may be conservative and skewed towards reducing risk. If so, you would be more likely to avoid riskier investments regardless of their reward. Alternatively, an aggressive strategy may overlook increases in risk in favour of seeking larger rewards.

You can expect that the further to the right you go on the graph, the more perceived risk an investment has. In monetary terms, the more likely you are to lose some or all of your money. As you go up on the graph, the higher the perceived reward should the investment be successful. In monetary terms, this could be increases in the value of the asset or ongoing payments to you.

Your job as an investor is to determine your risk tolerance, and then find investments that suit that risk tolerance.

Ideally, you want to find investments that appear to have perceived rewards that outweigh their perceived risks.2 From the earlier graph, anything that sits above the risk-reward line would be an investment that can provide a reward that is worth the risk. Conversely, anything below the line has risks that outweigh the rewards and may not be an ideal investment.

Here’s how these areas look on the graph:

We now have two sections on the graph – a green section and a red section. The further into the green section an investment is placed, the greater the reward of that investment proportionate to the risk. The opposite is true for the red section – investments further into the red section and away from the centre line have a higher risk proportionate to the reward.

Applying Risk vs Reward to Investments

But what does all of this mean? How can you use this to decide if an investment is right for you?

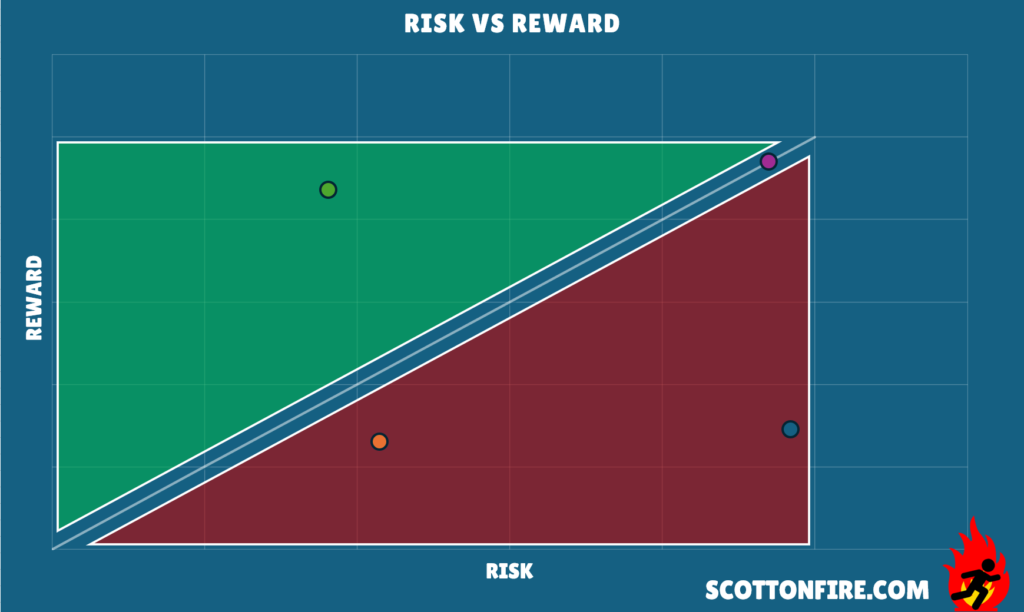

Let’s see how various investments fit on this graph:

As you consider the risks & rewards of investments, they will fall somewhere on your risk-reward spectrum.3 As you research potential investments, you’ll gain insights into where they fall on this spectrum.

I’ve prepared a graph with four investment opportunities. In this example, you can see that some investments are perceived as high-risk (blue and purple), and some are perceived as high-reward (green and purple). The orange dot has both a low risk and a low reward.

Adding the coloured sections back in gives us some interesting information:

One investment stands out to me as a clear option to consider – the green dot. The green investment has a reward that is much higher than its risk. Its distance from the risk-reward line makes it an ideal choice for an investment.

The orange and blue dots are both too risky for their potential reward – especially the blue dot. The purple dot sits right in the middle of what we consider reasonable risk & reward. This could also be a good choice.

Different Investing Styles

The challenge is that certain investments may be considered riskier to different investors. An investor may demand a higher reward for the level of risk they accept. This means that they’re less likely to make riskier investments. This would alter the graph like so:

The investment dots haven’t moved, but the risk-reward line has. This shifts the red and green areas of the graph as well.

Now, the purple dot is firmly within the red area. This investor would therefore be less likely to invest in the purple dot. The other three dots remain unchanged. For this investor, the green dot is likely the only investment they will select.

Understanding how you approach risk will affect the types of investments you are likely to make. As your investing goals will likely change over time, you may need to re-evaluate previous investments to see if they remain aligned with your changing risk tolerance.

Evaluating Investments

Now that we’ve discussed risk vs reward, we can talk about other factors relevant to investing decisions: time horizon, past performance, diversification, and exit strategy.

Time Horizon

Your time horizon refers to the amount of time you want to remain invested. Some investment strategies involve buying and quickly selling assets to make small and fast profits. Other strategies, such as “buy and hold”, have an effective time horizon of “forever”. The intent of this investment is to never sell, instead relying on dividends paid from the investments to serve as your reward for being invested.

Certain investments have shorter time horizons than others. A bank account that pays you interest has a time horizon of 1 month. You can transfer your money out immediately after the interest is paid.

Other investments may recommend a holding period of years or decades, due to the volatility of the investments.

Common considerations when evaluating your time horizon include time until sale, time until retirement and time until expected death. Planning the time horizon of your investments becomes important during retirement planning, to make sure you don’t run out of money during retirement.

Past Performance

People often look to past performance of investments when evaluating if an investment is worth it. However, past performance is never an indication of future performance. If an investment has risen in value every year for the last few years, there’s no guarantee that trend will continue. Even when reviewing historical data over long periods of time, the data only shows what happened and not what will happen.

Exercise caution when presented with investment opportunities that “guarantee” a specific return. Even if their historical data shows it happened before, it doesn’t guarantee it’ll happen again. Try to view the investment’s entire history, including periods of negative returns, rather than a section that only shows a good return.

Diversification

Diversification refers to the risk associated with specific industries, countries, asset classes or market sectors that a particular investment falls under. Many investments, like stocks or shares in companies, are inherently not diverse. The stock provide ownership of a single company, and that company likely operates in a single industry. If that industry faces challenges, this company would likely suffer as a result.

It is important to consider diversification across your whole portfolio of investments. By diversifying your investments across different asset classes and industries, you can avoid challenges impacting one of those industries. This can reduce overall portfolio risk, especially if one of your investments would succeed if another in your portfolio fails. You may find that the risk of certain investments is lower if your portfolio is diverse enough to offset any volatility or loss.

Exit Strategy

An exit strategy defines how you plan to close your investment position. You can sell assets like stocks quickly through your brokerage account. Other assets, like houses or fine art, take considerably longer to sell. Sometimes, this can even affect the price you sell for.

An exit strategy is important, especially if you need to quickly convert your investment back into cash.4 Ensure that you understand how to sell your assets and plan around the delays associated with that process.

Questioning Investment Opportunities

To summarise, there are many questions you can ask to determine if an investment is right for you. Some questions could include:

- How long do I need to remain invested in order to mitigate risk and increase my chances of reward?

- What value does this investment offer me or a prospective buyer?

- Do I have all of the financial information regarding this investment?

- Does the information source have a vested interest in me engaging with their investment/ platform for their own benefit?

- Is this asset diversified enough on its own?

- Does this asset support my existing portfolio by diversifying it across industries and asset classes?

- What do I have to do to close this investment?

- How long does it take to get money back?

Investing your money can result in handsome rewards. But you need to consider if the investment is right for you based on your own risk tolerance and financial goals.

Types of Monetary Investments

There are many different ways for you to invest. As mentioned earlier, everything you do is an investment. Therefore, everything you can do with your money is a form of investing that money.

This section serves as an introduction to many different ways you can invest your money. The options vary greatly in quality and is not exhaustive. There are many other things to invest in that aren’t included in this list.

Using the concepts we’ve discussed so far (entropy, inflation, risk vs reward, diversification, etc.), try to evaluate each investment based on each of those concepts and the questions above. As I will never give direct financial advice, my approach is for the reader to understand how to determine ideal investments for themselves.

Cash in the Bank

Storing your cash in the bank gives you a digital record of how much money you have. Banks often have fraud protection services that protect your money if you encounter fraudulent transactions. Most banks also give you access to a savings account, allowing your money to earn interest (usually less than inflation). Banks and their customers usually benefit from government insurance schemes, which protect customer’s money if the bank goes bankrupt.

Storing Money in your Mattress

You can cut a hole in your mattress and hide your cash in it. The money is probably very difficult to find, as not many people would think to check inside your mattress. However, if somebody does find it and takes it, you won’t have any protections available to you. As the money isn’t being used for anything and is held in cash, the money is also not protected from inflation.

Term Deposits

Banks often offer their customers term deposit services. This service offers a guaranteed return as long as you agree to lock your money in an account for a specified period of time. Term deposits guarantee that your number of dollars will go up – whether the rate beats inflation is another question. If banking with a reputable bank, your funds will often be protected (up to a limit).

Real Estate

Real estate refers to property, like land, houses, apartments, or business properties. Investing in real estate is often a lengthy process, requiring market research, competitive pricing battles, and high upfront and ongoing costs. Selling properties is similarly lengthy. However, owning a physical property can have a different feeling to investing in non-tangible items. Certain investors value the permanence of property versus stocks or other assets. Real estate is often rented to provide ongoing cash flow to the investor.

Stocks/ Shares

Stocks, or shares, refer to pieces of ownership of a company. Large companies have their ownership splits into thousands or millions of small pieces, or shares. Using a brokerage account, you can purchase shares in specific companies. With thousands of companies to choose from across markets all over the world, it can be difficult to know which ones to buy. But investors with particular strategies can use stocks to easily invest in specific industries or technologies and be rewarded for their research.

Friend’s/Family Member’s Business

Your friend or family member may have an idea for a new business, or even an established business that they want to expand. This person may require an investment to get the business started. The possibilities for what the business could be are endless.

Remember – your downside risk in certain investments may not be limited to your finances.

Bonds

Bonds are a type of purchasable debt offered by governments and some companies. Ownership of a bond entitles you to coupon payments of interest on a fixed schedule, with the value of the bond being repaid at the end of the term. Bonds are generally secure, although there is a risk that the underlying party could default on the debt.

The rates of return for bonds fluctuate with the cash rate issued by the Reserve Bank. Bonds with lower interest rates will lose value as the cash rate rises, as the coupon payments received will be lower compared to inflation. Similarly, bonds become more valuable if opened with high interest rates rise in value as the cash rate falls.

Precious metals

Precious metals are valuable, naturally occurring elements that are extracted from the earth. Gold, silver, and platinum are precious metals. People use these metals to make jewellery, technological components, and other opulent objects.

Many people consider precious metals a worthwhile investment, due to their scarcity and obvious use cases. However, the future value of precious metals is speculative. One must also consider the storage of the precious metals, as well as insurances, authenticity, and exit strategy.

ETFs

ETFs, or Exchange Traded Funds, are slices of ownership that are similar to stocks. Rather than representing ownership of a single company, ETFs often contain small ownership in a vast number of different companies.

Many ETFs also track indices, giving investors the ability to easily own a particular set of stocks (for example, the top 200 stocks on the Australian Securities Exchange). Some ETFs allow buyers to invest in other assets, including cryptocurrencies and precious metals, with the ETF manager overseeing the underlying assets.

ETFs are popular due to their low fees and extreme diversification.

LICs

LICs, or Listed Investment Companies, are companies that invest in other companies. Compared to ETFs, LICs use a targeted strategy to invest in particular companies that meet their criteria. As a result of their asset allocation, LICs provide diversification, but in a different manner to ETFs.

Collectibles

Collectibles can refer to many different things, including toys, games, figures, shoes, clothing, or trading cards. The collectibles market is interesting in that many collectibles can often be acquired for reasonable prices upon their release. Many start their life as items you can buy in stores, but can become extremely rare over time if kept in good condition.

Many collectibles require a long time horizon for the items to become rare, but also require a market to sell the item to. Holding on to the right collectible can be extremely profitable, though there are many other collector items that may never yield a meaningful return.

Art

You can invest in paintings, sculptures, or other works from artists (prominent or amateur). Iconic paintings are often priceless, however knowing what makes a painting “iconic” is in the eye of the beholder. As art ranges wildly in price, quality, and style, finding a buyer (or renter, through an art rental service) may be difficult. However, like collectibles, the potential upside on art may be of interest to some investors.

Cryptocurrencies

Cryptocurrencies like Bitcoin or Ethereum (and yes, even Dogecoin) are digital currencies that exist entirely on the internet. Through a series of decentralised ledgers that are run on computers all around the world, these currencies can be traded with each other. You can trade real currencies for cryptocurrency via crypto exchanges, and conduct crypto-to-crypto trades through “wallets” that are accessed via phone apps or web browsers.

Cryptocurrencies are known for their virality and explosive price movements. Many cryptocurrencies have no inherent value, with the value set by the price traders are willing to pay for them. Some, such as Tether USD, claim to be backed 1:1 with specific assets – each Tether USD is supposedly backed 1:1 with US Dollars. Crypto has many scams and the technology behind it is still relatively new and difficult to use at times.

Due to rapid price movements, difficult to learn technology and risk of total collapse, placing money in cryptocurrencies is not for the faint of heart.

NFTs

If we’re talking about cryptocurrencies, we have to talk about NFTs as well. NFTs, or Non-Fungible Tokens, refers to crypto-based tokens that are linked to a specific asset. Many NFTs available on the market are art-based, linking the NFT to ownership of a digital image. Of course, there’s nothing stopping someone else from just right-clicking and saving the image for themselves. NFTs don’t offer protection to the image in that sense.

NFTs as a technology are more than just images, though. A cryptocurrency wallet containing NFTs can interact with apps to grant specific permissions based on the NFTs held. Gods Unchained is an excellent example of this in action. In this digital trading card game, you can trade the rare cards you own for cryptocurrency (and therefore “real money”).

Like cryptocurrencies, many NFTs don’t have any inherent value, and rely on “greater fool theory” to sell for a profit. But some NFTs offer benefits in games or communities and be independently verified without any third parties involved. The technology is new, but it does have uses as a decentralised method of offering specific permissions to users.

As with cryptocurrencies, NFTs are a new and emerging technology. With many new technologies, you will find opportunists trying to scam or make a quick buck. Do your research and approach with caution.

Closing

Learning how to invest your money is essential. And knowing how to decide if an investment is “worth it” for you is also essential. There will be some on this list that you love and want to research further. You may find that you dislike certain choices.

I hope this post has given you some thought as to how to approach your investments (financial and otherwise), and to decide for yourselves what you plan to research further.

Next time, we’ll talk about what you need to get started with actually making investments, including finding investment platforms and how much money you’ll need to start.

Next: Investing Series Part III – How To Invest.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.

- The relationship between risk and reward is much more nuanced in the real world. This is an illustrative example. ↩︎

- I use the terms “perceived reward” and “perceived risk” as most financial decisions are made with incomplete information (even by the experts). As a result, every instance of “risk” and “reward” can be replaced with “perceived risk” and “perceived reward” respectively. ↩︎

- While you could plot them on a graph like this after weighing up the pros and cons, this exercise is probably done mentally. ↩︎

- An emergency fund is an investment towards your financial security and peace of mind for this reason. ↩︎