Saving money is essential if you want to create financial stability in your life. But knowing how to save money – and having the means to do so – is often easier said than done.

The reason why saving is so important is that it serves two critical duties in optimising your finances.

This piece is part of my Saving Series, where I break down my thoughts on how to save, why you should develop a saving strategy, and what aspects of life unlock for you if you do.

My focus for today is to talk about the self-serving benefits that saving money provides for you. These benefits are achieved through the twofold effect of saving.

How To Save Money, Simplified

Saving, put simply, is money left over from the cost of providing for your needs, and the needs of your dependents. Those needs include physiological needs (like food and shelter), security, costs associated with earning an income, and meeting your entertainment, psychological, and spiritual needs.

There are two methods for how to save money:

- Mandatory saving

- Bonus saving

Mandatory saving is intentionally planned saving that you build into your budget each pay cycle. This essentially means “paying yourself first”.

You can set aside a portion of your money at the start of your pay cycle, using an automatic bank transfer. Put the money away in an account that you won’t touch – ideally one with a high interest rate.

Doing this intentionally, as soon as you get paid, means that you are saving towards your goals without having to consciously squirrel money away. Your savings are the priority, and you’ve built that into your lifestyle. You are in full control of the transfer, but as it happens automatically, it doesn’t take up space in your mind.

You don’t need to find money each pay cycle to save if you pay yourself first.

Bonus saving is every other type of saving. You can find bonus savings by checking how much money you have left over at the end of your pay cycle, then deciding to save that money. This type of saving is “paying yourself last”.

Bonus saving won’t allow you to save consistently. Expenses are rarely consistent, and having a higher bank balance for longer means that you are more likely to spend that money – especially if you use a card and not cash.

Treat this type of saving as its namesake – a bonus. If you only save money you have left over at the end of the week and nothing else, your savings plan is not sustainable.

On Windfalls

There will be times where you receive a windfall – a large amount of money at once. This will likely happen several times in your lifetime.

You may receive money from an inheritance, a bonus from work, or receive a large amount of money from a side hustle or sale of an investment.

However you receive the money, you must think about how you approach mandatory and bonus savings from that money.

Will you save a fixed portion of it upfront and spend the rest? Or will you simply let it sit in your everyday account and spend it over time?

It is very easy to spend money if you are not intentional about how it is deployed.

It is your duty to be intentional at all times.

Savings or Profit?

Let’s think about saving another way.

Businesses incur costs throughout their operation. Businesses have entire teams dedicated to solving the problem of how to save money.

Mandatory savings in a business sense is derived from a portion of the businesses’ profits.

Profit is money left over after the business has subtracted its expenses (outflows) from its revenues (inflows).

Businesses keep a portion of profits to either invest further into products and research, to pay down debt, or to save for a downturn in the market.

This allows them to both grow and survive in the market – two mandatory characteristics of any good business.

These retained profits are a form of mandatory saving that the business has determined is necessary to meet its ongoing obligations.

Upon calculating profits for the business year, there may be a higher profit value than expected. This could be deployed as above, as a form of bonus saving.

But why do businesses describe their savings as profits, while for us it’s just saving?

You should see the money you have left over not as savings, but as profit too.

Not only does it teach you to think like a business, but it also encourages you to be proactive about how you achieve profit in your personal finances. You can utilise your money as efficiently as possible by adopting a strategy based on business-focused thinking.

The focus on deliberate, mandatory saving will create a mechanism by which you can continue to profit financially.

Why Should You Save?

Saving money is a necessary part of life. As savings are the means by which you profit as a human being, saving money is therefore akin to successfully operating your life in surplus.

It’s the barometer by which you determine if you are getting ahead or falling behind. If you aren’t saving at least a small amount, entropy suggests you are going backwards.

This doesn’t mean that if someone doesn’t save any money in a given week, month, or year, they are a failure. Instead, consider how much you’ve saved throughout your lifetime rather than a specific period.

A period without saving is not bad if you are working towards a bigger goal:

- Studying to unlock higher paid work

- Responding to changes in circumstances

- Dealing with bad luck

Not saving shouldn’t be the norm, but there are times when savings may need to be put on hold.

Your aim is to ensure that you are always in a position to save effectively.

The Twofold Effect

Increasing the amount of money you save has two distinct benefits:

- Your ability to provide for your future; and

- Your ability to thrive on a lower income amount than you can earn.

Both of these have a profound impact both your money philosophy, as well as your ability to pursue financial independence.

Provide For Your Future

Everyone needs money. It is an inescapable fact of life.

If you can consistently save a portion of your income, you are able to store human effort for your future benefit.

The money will become whatever you want or need it to become.

Creating profit through running your life like a business will ensure that you have the ability to provide for your future self and your dependents.

The more money you save towards this goal, the faster your money will compound if invested.

A higher saving rate percentage will ensure that you have the ability to achieve financial independence. This allows you to retire early, or Choose Work You Love.

Survive On Less

The ability to achieve financial independence will occur sooner if you are able to save a large portion of your income.

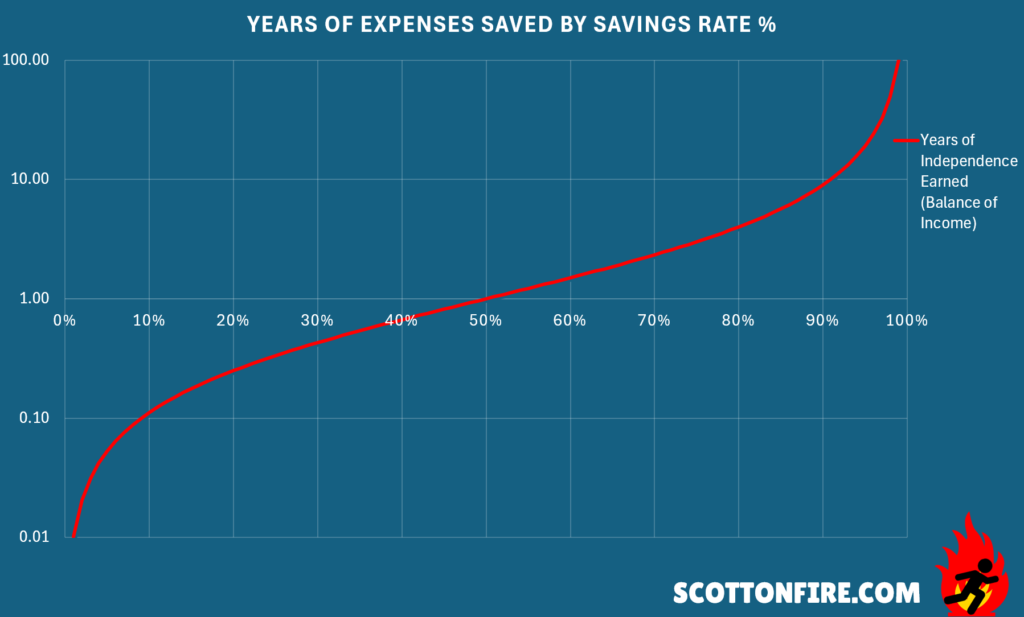

As your savings rate percentage increases, so too does the number of years you buy by saving. I explore this in detail here.

The reason for this is because by saving a large portion of your income, you are avoiding spending all of the money you earn. This means that you can survive on a lower amount of income – a lower amount that you are subconsciously setting for yourself by intentionally saving.

You can take advantage of this by working extremely hard to earn a high salary, and saving as much of it as possible. This is a common strategy for achieving financial independence early, as it allows you to benefit from the effects of compounding later in life by focusing on investing early.

This strategy allows you to take control of your financial future. Building an investment portfolio ensures you can maintain a lifestyle that you love without relying on a salary.

Saving teaches you to find your “enough”, and save the rest for your future.

Optionality

Having savings gives you options. With more money in the bank, you have more options when you financial circumstances change.

This is why emergency funds are a crucial component of any finance strategy. You need the safety net of cash to fall back on in the event of a major expense.

But having options also happens the other way, too. When your income increases, you have options around how you approach saving the additional money, and how you use it to improve your lifestyle.

Imagine a person earns $50,000 net per year and saves $10,000 of that money. This means that the person have a 20% saving rate, and is able to meet their needs on $40,000. Imagine also that this person receives a raise, and their income increases to $60,000.

This person has a few options open to them regarding how to change their strategy following the raise:

- Save $10,000, increasing their saving rate to 33% ($20,000 / $60,000)

- Save $2,000 to maintain the 20% saving rate and spend the rest

- Save $0, and spend the full value of the raise to improve their lifestyle

- Work less hours by taking advantage of leverage and maintain the 20% saving rate

Now imagine a similar scenario in reverse.

The person’s income has fallen from $50,000 to $35,000, and they were saving $10,000. They need $40,000 to meet their needs.

What options are available to them now?

- Use savings to maintain lifestyle until more income is achieved

- Continue saving and sacrifice other aspects of life in the short term

- Work more hours to cover the shortfall in income

None of these options are ideal. But if this person did not begin saving at all, their only options would be to sacrifice aspects of their lifestyle, or work even more hours.

However this person plans to progress, they need as many options as possible to make their journey through life an easy one.

Spending all of your money every pay cycle almost guarantees that you will struggle later in life – even if you live in a country that has retirement accounts bundled with employment.

Closing

Knowing how to save money is important, even if it is difficult to do at times. That said, it is required in order to ensure your life runs at a profit.

Your savings give you options with regards to how you interact with the world around you, and whether you need to keep working in old age.

Use the twofold effect of saving to maximise your personal profit. Create as large a gap between your income and your expenses as you can, as early as you can.

Let the spending you engage in inform what “enough” means to you. Don’t allow the world to tell you what to buy and how much to spend. Set a healthy amount of spending that allows you to save diligently without sacrificing your health or sanity.

If you can achieve both, you will be able to save while also maintaining a healthy relationship with your money.

To tie this concept back to my personal philosophy, saving is the vehicle by which you are able to invest and choose work you love.

Your savings can be invested in your security, your growth, and in other investments.

This gives you the freedom to pursue what you truly desire in life, while building the security that will underpin your life going forward.

Saving a little bit of your money is the start of an outward spiral that will grow larger and larger until you break free from your original life and pursue your Life’s Work.

I believe everyone holds a desire to pursue what they love, and that saving is the key to unlock a life where that is possible.

Thank you for reading.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.