Discovering Financial Independence changed my life. Learning I could retire years or decades ahead of my peers was a huge motivator to start investing. But achieving Financial Independence quickly became the only goal I was aiming for. After several years of saving and investing towards this goal, I burned out of my corporate career. It was only after taking time away from work that I found a strategy that worked for me. Slow Financial Independence – a healthier and intentional lifestyle design philosophy.

Traditional Financial Independence can be perceived as involving intense sacrifice and an almost ascetic lifestyle. Its focus on maximizing investing comes at odds with the desire for living a good life in the present. Slow Financial Independence takes this concept of traditional Financial Independence and turns it on its head.

The standard approach to FI has antagonises work and rushes you to rid yourself of it. But Slow Financial Independence encourages you to build a life in which work is a healthy and sustainable aspect. You use your free time for other pursuits, including work you enjoy and learning new skills. This lifestyle allows you to use the benefits that Financial Independence provides before reaching your “number”.1

The essence of Slow Financial Independence is separating your income from your time, Choosing Work You Love, and creating a life you don’t need to retire from.

I see Slow Financial Independence as the ultimate strategy for living an intentional, healthy, prudent, and pragmatic life.

This is another instalment in my FIRE Series. I discuss options outside of the normal path through life, and the principles behind why they work.

What is Slow Financial Independence

I define Slow Financial Independence as follows:

Slow Financial Independence is a lifestyle design strategy that uses the incremental advantages provided by saving and investing without sacrificing your future Financial Independence goals.

This concept was coined by the Fioneers a few years ago, but I only came across it recently. I eventually found that there was a name for the lifestyle I had begun to pursue.

Over the last 12 months, I’ve created a life I love by leveraging the benefits of my savings and investments. Achieving Financial Independence was my original goal, but my thoughts on Financial Independence as my relationship with work changed. This was the catalyst that led to me changing my life and transforming my relationship with money.

This taught me one of my most valuable insights into the concept of Financial Independence:

Financial Independence is Not the Primary Goal

I pursued Financial Independence for five years before it and work burned me out. I had to go through that to realize that FI was not the goal I thought it was.

On the surface, saving and investing your money is incredible. You gain control of your time, and live the life you want. But in the case of traditional FI, you only get to do that last part once you achieve your “number”.

I don’t believe that Financial Independence is bad—far from it. Financial Independence changed my life and allowed me to live the lifestyle I currently enjoy. Traditional FI is excellent wisdom to use to create your own life strategy, but a terrible strategy in isolation.

Traditional FI as a strategy puts you at odds with the lifestyle you currently live. It suggests that the only way to a happy life is to have a massive pile of money. All this does is further reinforce the mindset that money is the only thing that matters.

Slow Financial Independence Embraces Work

I also dislike how Traditional FI antagonizes work. Those driven enough to pursue FI are unlikely to never do anything of value to others in the future. These people aren’t the type to kick their feet up and never lift a finger again. They continuously strive to make life better for themselves and others. Providing service to others rewards you in many ways, including financially.

Traditional FI plants a seed of contempt for work, as though work is the problem. But as I’ve written about before, I see work as the solution.

Work is simply the challenges we overcome in our lives. If traditional FI didn’t imply that work was the problem, it wouldn’t encourage you to save enough so that you never had to do it again.

Work is an essential part of life. It’s a way to become better at anything you desire while getting paid for the privilege. It’s a given that not everyone can do every type of work. That said, there are enough lucrative types of work available that make any desired lifestyle possible.

The crux of Slow FI is this:

If you enjoy your work without it destroying you, you are fulfilled, and you are earning enough for now and your future, then what reason would you have to give up work entirely?

Creating a lifestyle in which you engage with work on your own terms is the goal. And Slow FI is the philosophy that makes that possible.

FI is a By-Product of a Life Well-Lived

So, does that mean that people pursuing Slow FI don’t want to achieve Financial Independence?

Well, yes and no.

No, Financial Independence is not the primary goal under Slow FI. Instead, the primary goal is to create and live a life you truly love.

But yes, those pursuing Slow FI do ultimately plan to achieve FI. It’s just that they carefully construct their life such that FI is not required for it to be successful.

Doing work – doing hard things – is how we grow as people. Continuing to do the same work in the same way over many years does not allow you to grow. Instead, it reinforces that you are a cog in a machine. The machine that all proponents of FI are longing to escape.

Slow FI simply allows you to escape much earlier.

Living a lifestyle that allows you to learn and grow makes you better at doing more things. These skills allow you to increase the value of your time. If you can learn skills that people or businesses are willing to pay you for, you unlock new and better methods of earning money. Slow FI gives you the freedom to learn these skills and insert work into your life for maximum benefit.

This approach puts appropriate emphasis on achieving FI, without it becoming all-consuming. Rather, achieving FI becomes the side effect of living an intentional and good life.

Improve Your Present Without Sacrificing Your Future

Slow FI gave me the space to understand how I want to work, how much I need for the present, and how much I need for my future FI goal.

I wrote about this in more detail in Earn Enough But No More. There, I described my strategy of intentionally working less than full-time to maximize my effective hourly rate, reduce my tax by spreading my income over more financial years, and extend my working career in a sustainable manner.

The purpose of Slow FI isn’t to put off thinking about the future – in fact, it’s the opposite. It places such a granular focus on your entire future that, unlike traditional FI, that vision also includes tomorrow.

In the last 12 months, I’ve worked for an income2 for about two of them. I also visited family interstate twice, attended two FI retreats, started a business, and began creating content online. I do my best to keep expenses low, which allows me to spend money on the things that I truly enjoy.

I’m not an extravagant spender, but this lifestyle doesn’t require me to live like a monk, either.

This year has taught me that not only does Slow Financial Independence work for me, it has allowed me to live one of the best years of my life. Most importantly, it allows me to continue working towards full Financial Independence without sacrificing my present happiness.

Is Slow Financial Independence Just Coping?

I’ve seen discussions online suggesting that Slow Financial Independence is a coping mechanism for people who can’t pursue full FI. This is a surface-level take that doesn’t consider the benefits of why someone would choose Slow FI over traditional FI.

Slow FI doesn’t mean you’re pursuing traditional FI in a slow way. It’s not the same as finding FI later in your career, or only saving a smaller percentage of your full-time income. There is nothing wrong with either of these two approaches (any amount of saving and investing is good). But it seems that these approaches to traditional FI get conflated with Slow FI.

A Slow FI lifestyle is a total redesign of a normal life, made possible thanks to the passive income derived from partial Financial Independence. It allows you to strip away aspects of your life that you no longer need, and replace them with aspects that suit your changed needs.

For those who resonate with Slow FI, achieving FI was never the ultimate goal. Problems don’t magically go away when you have money, and I’m not going to subject myself to more work than I can bear in order to achieve more money now. I’d rather dedicating my time to working to solve other problems in my life, rather than engaging in excessive work and attempting to pay my way through those problems.

On Other Variants of FIRE

There are many offshoots of FIRE that I believe are simply redundant. Many are based on fixed dollar amounts while following the same traditional FI strategy. Their categorisation offers no real benefits and doesn’t address the most important aspect of wealth creation: a high income. The emphasis is always on a faraway future, that allows you to put off real decision making until the spreadsheet says you are ready.

Slow FI is different from every other strategy. It takes the concept of Financial Independence and moulds it into a framework that allows you to live a good life now — something that no other FI strategy does.

Why Slow Financial Independence?

By now you should have a pretty good idea of what Slow Financial Independence is. But why would someone want to pursue it?

Avoid Jobs You Hate

The simplest reason to pursue Slow Financial Independence is to stop doing work you don’t want to do. Whether it’s your boss, your tasks, your hours, the people you work with, or your ability to learn and grow, there may be something you dislike about your job. Slow FI puts you in the driver’s seat as to how you engage with your work.

Let’s break this down using some numbers in the 2025 Australian tax year.

Our friend is 30 years old and has started pursuing Financial Independence on their 30th birthday. They have a high income, but their corporate career is burning them out. Their work is enjoyable, but they’re simply doing too much of it for it to be sustainable. They earn $133,500 per year (about $100,000 net), spend $40,000 per year, and save 60% ($60,000).

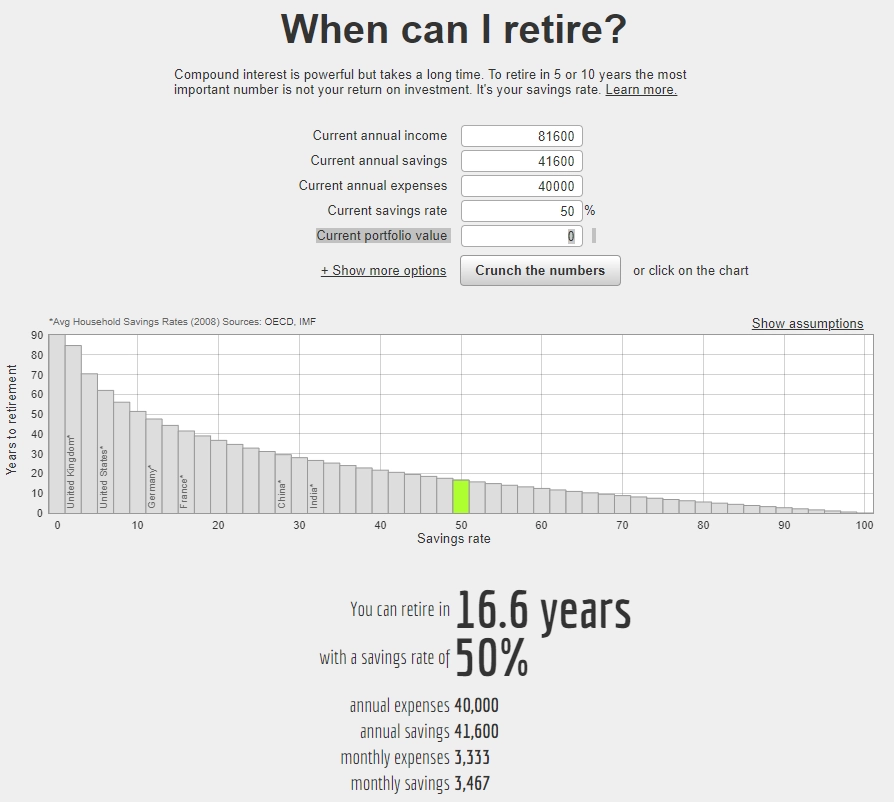

According to the calculator at Networthify, they’d be expecting to achieve Financial Independence by 43 years of age:

But what if our friend uses Slow FI to change their life in the present?

Let’s say that instead of working 5 days a week, our friend works 4 days a week. They lose 20% of their gross pay, leaving them with about $81,600 net3. If we then put this number into the same calculator with the same expenses, we find that this decision increases their time to retire to 16.6 years, adding 4.2 years to their career:

Pursuing a Slow FI strategy has allowed our friend to work in a way that aligns with their life goals, allowing them to continue towards FI without burning out in the process.

As stated earlier, work itself isn’t the problem. The problem is the lack of control over the work or how they engage with it. This approach leaves our friend happier and more fulfilled, before considering the benefits an additional day of free time every single week offers to a motivated individual.

Applying to Your Situation

This is a simplified scenario, and of course, a real analysis will be more involved than this. But taking the time to consider how changing your work hours or changing your job will impact your finances gives you the insight necessary to make these big steps.

The best part of Slow FI is that it’s extremely modular. Our friend above could conduct another analysis after reaching an FI % milestone. For instance, they could see how their relationship with work would change if 40% of their income is covered passively. This could allow them to drop down to 3 days of work a week, while still pursuing FI.

Thorough and continued analysis of your lifestyle may reveal that you can change your relationship with work much sooner than you think. This allows you to avoid doing a job you hate and move you towards Choosing Work You Love.

Choose Work You Love

“Choose Work You Love” has become a slogan of mine in recent months, and for good reason. I think that Choosing Work You Love, that you are truly committed to, allows you to create incredible things and live in accordance with your vision.

A Slow FI lifestyle means deliberately freeing up time to discover what you love. Once you discover it, you’ve already freed up the time necessary to perform that work. All you need to do now is the work itself.

Your investment of time, money, or effort may provide rewards in the form of fulfillment, community, or, in some cases, income. Slow FI allows you to create a lifestyle of alternatives—alternative working arrangements, alternative pastimes, and alternative methods of making money.

I used to have a problem with people who made money in unusual ways, or tried to sell something to you. Many people think of salespeople as pushy or underhanded, who will do whatever it takes to close a sale. That might be true of some salespeople, but I’ve learned that there’s nothing wrong with selling something or making money.

Slow FI & Intentional Work

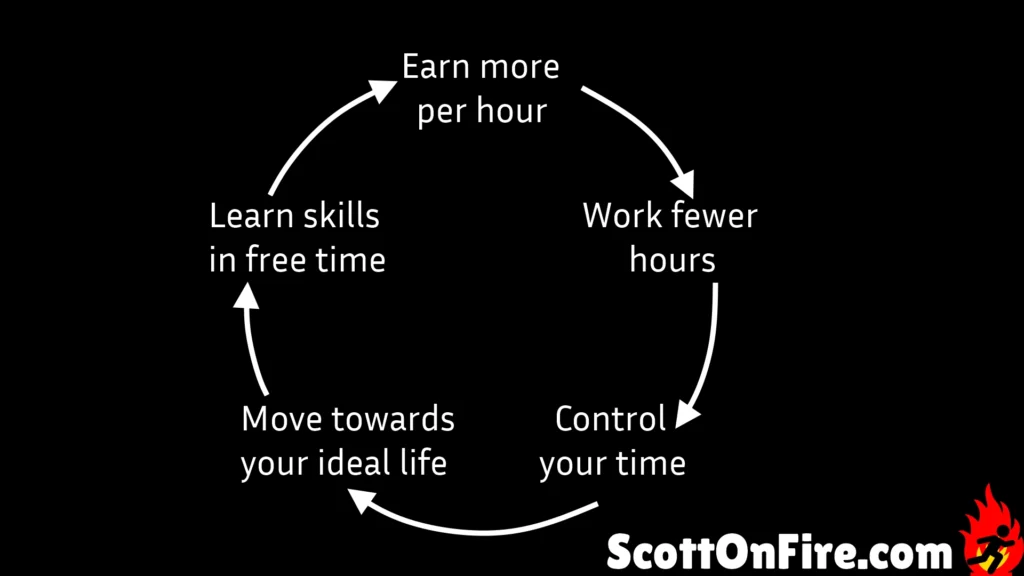

Slow FI provides two unique benefits: it puts you in a position to sell your skills and expertise in a way that a traditional job does not allow, and it gives you the freedom to build the skills you need to become even more valuable. These skills increase the amount you can earn per hour, allowing you to continue working less and keep building the life you want.

I spoke about this Circle of Value in a YouTube video recently if you’d like to learn more about this concept.

Create a Life You Don’t Want to Retire From

While Slow Financial Independence encourages you to live a life that allows you to become financially independent in the future, this isn’t the primary goal. The goal is to create a life you don’t want to retire from.

For many people, work offers purpose and meaning beyond just remuneration. Forgoing work entirely can strip you of the value you spent half of your good waking hours pursuing. There’s no problem with working, so long as you seek to control it rather than it controlling you. And if you can incorporate it into your life in a healthy manner, then there’s no rush to achieve Financial Independence.

I plan to become financially independent by the time I’m 40 years old. But it’s not an issue if I don’t achieve this. After all, the life I live right now is the most liberating I have ever felt. I want to ensure I can earn enough to sustain this lifestyle and secure my future. But I also want to work in a way that supports my ability to enjoy it. Financial Independence will happen, but I’m in no rush. And any step I take in the right direction will be one better than not having stepped at all.

If you enjoy your work and earn enough for the present and the future, you don’t need much else. You also don’t need to push yourself as hard as you think.

Slow Financial Independence Concerns

Of course, Slow Financial Independence isn’t without its risks. I may see it as the optimal strategy in my own life, but that doesn’t mean it’s foolproof.

Here are a couple of the challenges associated with Slow FI and how I plan to solve them.

“You are Wasting Your Good Earning Years”

It’s easy to look at Slow FI and think that it’s a waste of time. That you could continue working in a way that you don’t really want to in order to reach FI a little bit sooner. That by reducing the number of hours you work, you are leaving money on the table instead of working as hard as you can to secure it for yourself.

My rebuttal to this is simple: what’s the rush?

What are you running from? What life are you living that your only solution is to save a million dollars in order to be happy?

Focusing solely on money denies an important truth: your good earning years are also your good living years. Entropy will not stop until it has destroyed us, so we have to live in a way that allows us to overcome it.

You can save your money and retire early as though work is the problem. Or, you can learn to incorporate work of your choice into your life in a sustainable manner.

If your concern is that you are wasting years of income potential, why not use your newfound free time to learn new skills and increase your income beyond the level you thought possible?

“What If You Fail to Find Work You Want?”

A key purpose of Slow FI is to allow you to Choose Work You Love. But what if you can’t find work you love?

My solution is to find problems you enjoy solving.

I have several skills that people and businesses will pay good money to access. These skills were acquired over nearly a decade in payroll and implementation projects. I wouldn’t have had the opportunity to learn those skills if not for the employers that took a chance on me. In many regards, I am extremely lucky.

That said, I wasn’t the only one benefiting from the employee-employer relationship. Even a pedestrian understanding of business management will reveal that businesses don’t hire employees unless doing so is profitable.4 And I know for certain that the value I added far exceeded the cost of my labour.

The skills I’ve learned allow me to take on work in almost any type of system implementation project. Implementing systems something I enjoy, but I also derive a high degree of satisfaction from solving large problems.

Find a problem that’s so big it will almost never be completely solved. Learn how to analyse and understand how people and businesses interact with this problem. Learn the skills necessary to solve that problem. Then find a way for people and businesses to become aware of your solution, and offer it to them.

Slow Financial Independence & Entrepreneurialism

I believe that pursuing Slow FI is best done by those who are willing to put an entrepreneurial spin on the way they work. This lifestyle rewards those who aren’t reliant on a consistent income. Forgoing a traditional career by working intermittently on contracts or as a freelancer provides two distinct advantages.

Working independently cuts out any middleman between you and the value you provide. It also puts you in a more agile position to take advantage of opportunities that arise.

Yes, this approach is harder to succeed in and much more volatile, but that’s the point. You leverage the progress you have already made towards FI to smooth out the bumps in the road. This encourages you to become independent in more than just your financial situation. This skill rewards you for the rest of your life.

This doesn’t mean that Slow FI isn’t achievable in a regular job either. The example I shared of a career worker changing from five days to four days per week certainly showed that it is. There is nothing wrong with being an employee if you have enough agency to work in a manner that aligns with your values. Slow FI makes it easy to continue down the traditional path until you gain the confidence and skill set to break free.

“It’s Impossible To Start Slow FI”

One genuine downside of Slow FI is that it is difficult to start a Slow FI strategy from nothing. Realistically, you start on the traditional FI path and then pivot towards Slow FI once you have some traction. But that doesn’t mean you can’t start with this approach in mind.

If you have a lucrative skill set or the ability to earn an income in a variety of ways, you can pull the pin on full-time employment much sooner than reaching 100% FI. If you have 30% of your expenses paid passively, you only need to earn the remaining 70% of your expenses. Earning more than this through your labour (e.g. earning 140% of your expenses) would allow you to save and invest half of your earned income, which provides the additional needed to continue working towards FI.

From there, continue to refine your strategy and ensure you’re able to meet your needs and invest enough to meet your goals.

Starting anything is always extremely challenging. I see the pursuit of Slow FI as a spiral that grows outward based on your professional and personal growth.

As you continue to gain the skills of saving, investing, and Choosing Work You Love, you become able to leverage those skills to live the life you desire more effectively. At first, the spiral spins rapidly as you make incremental changes to your life. But eventually, one rotation of this spiral becomes so broad and impactful that it changes the course of your life forever.

Closing

Slow Financial Independence is the path for how I’ve chosen to live my life. It’s allowed me to learn new skills and try a lot of new things in the last twelve months. The most impactful thing to come out of this experimental period is this site.

I’ve used my understanding of personal finance, philosophy, and the nature of work to attain full control of my life. Now I have the privilege of writing about how I achieved this lifestyle, and the challenges I encountered along the way.

The years I spent pursuing Financial Independence allowed me to pivot toward a more sustainable lifestyle. And as it turns out, I never wanted to rid myself of work entirely. I just wanted control of how I worked.

Whether it’s my work as a consultant, writing on this website, or anything else I commit myself to, all that matters is that I’m able to Choose Work I Love. All I need to do is earn enough for now and my future financial goals.

Slow Financial Independence takes the best parts of Financial Independence and blends them with a strategy that allows you to live an ideal life. And it all starts by Saving, Investing, and Choosing Work You Love.

Thank you for reading.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.

- The “number” refers to a dollar value based on roughly 25 to 33 times your annual expenses depending on your strategy and confidence in the market, which allows you to continuously draw from your portfolio without reducing its balance. I wrote more about traditional Financial Independence here ↩︎

- Day rate contracting as a consultant. I wrote about this here. ↩︎

- Yes this is a less than 20% reduction in net pay despite a 20% reduction in gross pay. This increases your effective hourly rate. I wrote about this in detail here. ↩︎

- Employees are profitable to the greater business. Some roles, such as customer service, aren’t profitable directly, but are necessary due to the size of the business. What I’m referring to here is the nature of employment as a concept rather than the profit or loss associated with any individual position within a company. ↩︎