Several years ago, I discovered that a life without mandatory employment was not only possible, but achievable for regular people. I discovered how to retire early – and no, you don’t need a big inheritance to do it. All you need to know is how to achieve Financial Independence.

Pursuing Financial Independence gives you the means to Retire Early, and engage in work how you see fit.

This isn’t a big secret – there are lots of people talking about how to do this.

Achieving Financial Independence is akin to finding the Holy Grail. A way out from working in a job you hate. A way to take control of your life.

The principles of Financial Independence allow you to create – and live – a life you love. The life you always wanted to live.

While I have not fully achieved Financial Independence, I put the principles of it into use throughout my life. Understanding the principles of FI allowed me to step away from my career in late 2023, build a consulting business, and begin writing online. This journey, and the knowledge of Financial Independence allowed me to discover a way of life that resonated with me.

To say that learning about Financial Independence changed my life is an understatement.

I will teach you how to achieve Financial Independence.

If this information is followed as prescribed, you will become wealthy enough to retire early – years or even decades before retirement age. This gives you the freedom to pursue your Life’s Work, improve your health and relationships, and become your Highest Self.

Whether you do so, and how you apply this philosophy, is another matter.

This post is the beginning of my Financial Independence Retire Early (FIRE) Series. The FIRE Series will focus on how to use the principles of FIRE to Save, Invest, and Choose Work You Love. This series will intersect with the Saving Series, Investing Series, and Work Series I also plan to write on this site.

My goal is to create a comprehensive and timeless guide that teaches how to maximise both money and meaning. This post is the beginning of that guide.

Before We Start

Before I can explain how to achieve Financial Independence, I must clarify the purpose of this guide.

This is not a get-rich-quick scheme. The information presented on this site will not make you a millionaire overnight. This guide will simply show you a framework to create a life of intentionality and freedom. Nothing on this site is to be considered financial advice.

This guide is intended to give you the tools to create a blueprint for building a life you love. It does not come with a blueprint. Instead, the information is intended to be foundational enough to give you the skills to create one yourself.

FIRE, Simplified

There are a number of irrefutable truths that underpin the Financial Independence Retire Early philosophy:

- In order to Retire Early, you must have enough money from which to sustain yourself throughout traditional retirement and early retirement.

- A retirement in which your income source is depleted is a catastrophic outcome, which must be avoided at all costs.

- As a human lifespan cannot be accurately forecasted, one must presume that their income source must last indefinitely.

- Therefore, a person looking to retire early must create an income source that will last indefinitely.

A person must achieve Financial Independence if they wish to Retire Early and never work again.1 Most people have no idea how long they are going to live. As a result, anyone looking to exit paid employment forever and Retire Early must build an income source that also lasts forever.

Your goal may be to Retire Early. Working full-time for fewer years than everyone else is a decent strategy. If you wish to Retire Early, you must be Financially Independent.

Achieving Financial Independence is the gateway to the ability to Retire Early.

So how do you achieve Financial Independence?

Achieving FI – Saving

As we’ve discussed so far, Financial Independence means that you have enough passive income to cover your expenses indefinitely.

There is only one factor that determines if you can attain Financial Independence: your Savings Rate. I’ll illustrate this using a simple example.2

Suppose we have two full-time wage earners: Lily, a management consultant, and Tom, a mechanic. Lily earns $200,000 a year, and spends $150,000 a year to maintain her lifestyle. Tom earns $90,000 a year, and spends $45,000 a year to maintain his lifestyle. Both Lily and Tom intend to maintain the same spending after retiring early.

Assuming this continues until they reach Financial Independence, who will be able to retire first?

If you answered Tom, you’d be right. Even though Tom’s salary is lower than Lily’s, his rate of saving (50%) is higher than Lily’s (25%). As a result, Tom can build up the savings required to fund his lifestyle much faster than Lily.

Let’s look at this a different way. Tom saves half of his salary ($45,000) each year, with the other half ($45,000) going towards expenses. In other words, this means that for every year Tom works, he could stop working for a year and be able to maintain his lifestyle.

In Lily’s case, she must work for 3 years before she can take 1 year off. Her $50,000 savings each year only accounts for a third of what she spends in a year ($150,000).

Let’s expand this out over a longer time period.

After working for twenty years, Lily and Tom have kept the same salary and saving rate. Tom has saved $900,000 during this time (20 times annual expenses), while Lily has saved $1,000,000 (6.6 times annual expenses).

For those wishing to retire early, being able to sustain your lifestyle for as long as possible is essential. As a result, Tom is in a much better situation than Lily, even though Lily has saved $100,000 more than Tom.

To summarise – the dollar value of the savings matters less than the saving % rate compared to your income.

Learning this concept changed my life, and was what led me down the path of pursuing Financial Independence.

Saving, Visualised

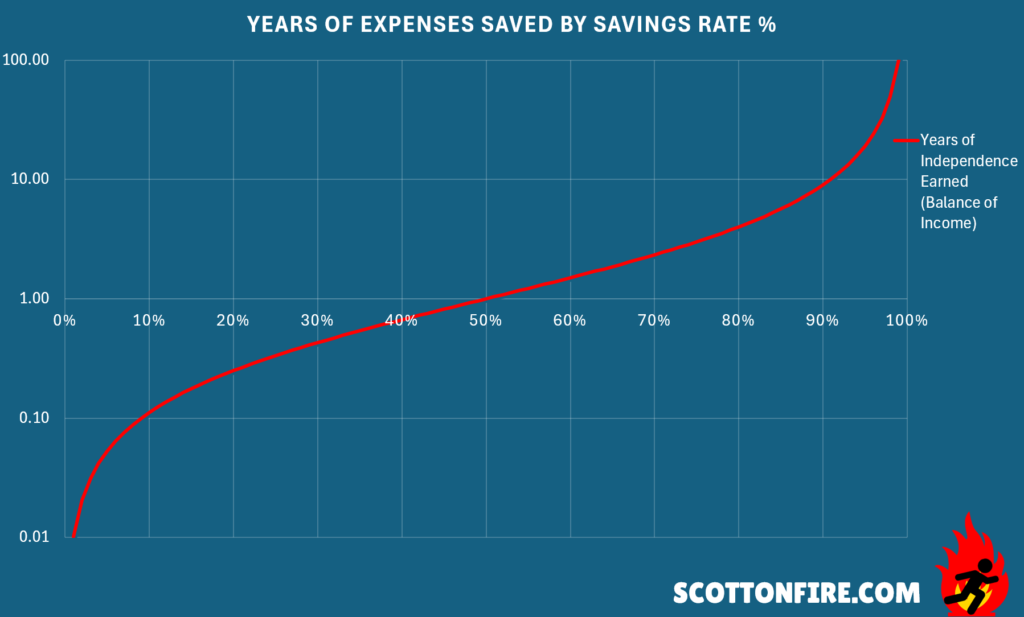

The figure that follows demonstrates the relationship between your saving rate and the amount of time your saving buys you:

The figure above shows how increasing your annual saving % rate (from left to right on X axis) increases the number of years you can fund your lifestyle without working (on the Y axis).3 The graph uses a logarithmic scale to better showcase the extremes in the data.

At extremely low rates of saving, you can see that a person would barely be able to fund any expenses at all. A 10% saving rate equates to saving 0.1 years of living expenses. If saving this much or less, expect to never retire.

At extremely high rates of saving, we see the opposite effect. If saving 90% of income, a person could fund 10 years’ expenses without additional income. A few years of this saving at this level would result in having your needs met for the rest of your life.

The $ value doesn’t matter if the rate of spending remains consistent during retirement. The only thing that matters is how much you save as a percentage compared with how much you spend.

Reducing your spending therefore has a twofold effect on improving your financial situation. You reduce the amount of money you need to live a good life, and increase your saving % rate, allowing you to Retire Early sooner.

The impact of high saving % rates reveals more irrefutable truths:

- As the proportion of saving vs expenses increases, savings become increasingly more valuable in relation to the time those savings can buy.

- The higher your saving rate, the faster you will save enough money to fund the rest of your life.

Saving is only one aspect of the equation. We must also consider how that money is invested, or how it is used to create the financial future we desire.

Achieving FI – Investing

Saving money alone is not likely to get you through retirement. The march of inflation is endless and threatens to devalue the purchasing power of the money you hold. Money must be put to work in order to preserve its value, and especially to grow in value. Investing is how you can retain and grow wealth while you prepare for retirement.

The money you gained from saving a portion of your income should be used to invest. As I’ve discussed previously, everything you do is an investment. Therefore, everything you can do with your money is an investment in a specific outcome.

Not all money deployed to the same investment is equal, either. An emergency fund held at a bank may have diminishing returns the more money you add to it. You risk receiving a lower return by not having your money invested in other ways.

The opposite is true, too. You can invest too much money into high-risk or volatile assets. This can result in substantial losses and lead to failure to maintain income in retirement. Irrefutable Truth #2 states that this must be avoided at all costs. Minimising risk exposure is essential to retain an income from your investments during retirement.

We must also consider what return you require from your investments during retirement. Your return will likely be comprised of income payments from your assets, as well as capital gains result from the sale of assets. But how much is enough?

Let’s take Tom from our earlier example. We know that Tom needs $45,000 a year to fund his current lifestyle. If Tom were to retire early, he would need an income source that pays him $45,000 per year, with minimal risk of failure.

We can now reframe the question: “How large must an investment portfolio be in order to return $45,000 per year?”

I cannot tell you the exact amount of money needed. But I can tell you how to forecast this for yourself.

Investment Returns vs Inflation

The purpose of investing is to triumph over entropy and inflation.

To do this, you need to earn returns that are worth more than the reduction in your money’s purchasing power due to inflation.

Inflation of the US Dollar averaged 3.3% between 1914 and 2014. In other words, a dollar in 1914 had the same purchasing power as $23.67 in 2014. You can flip the two to determine that a dollar in 2014 could buy about 4.2% of what a 1914 dollar could buy.

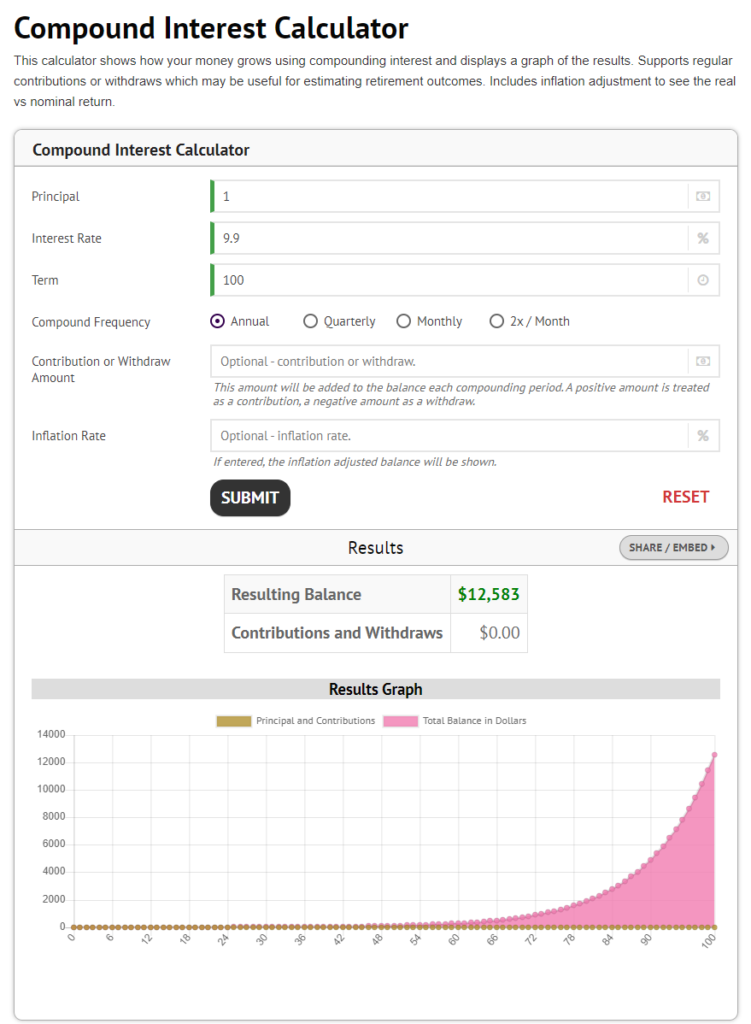

You can access historical stock market data online to see how certain investment classes have performed in the past. For example, the S&P 500 stock market index has returned approximately 10% per year since its inception. This is not consistent each year, but many 30-40 year consecutive runs resulted in positive outcomes. $1 invested at its inception would be worth $12,583 today:

Even if this example shows that each of the $12,583 buys about 4.2% of what they used to be able to, it doesn’t matter. 4.2% of $12,583 is $531 in 1914 money – $530 more than the $1 we invested. The investment returns vastly outpace inflation, which means that your wealth has grown over time. The compounding effect of investing over this time period has trounced inflation.

Even if each dollar loses value over time, the number of dollars in your investments will hopefully rise enough to offset this.

If you didn’t invest that $1, you’d still have $1. But that might only get you a chocolate bar instead of a nice meal.

I’m not suggesting to put everything into the US stock market because “it always goes up 10% every year”. It doesn’t – in fact, some periods experienced double digit losses year on year. Well-diversified portfolios that beat inflation are essential to retiring early.

Through this, we can reveal more irrefutable truths:

- Your wealth will grow if your investment returns exceed the rate of inflation.

- An investment portfolio must provide sustainable long-term returns in order to provide for you indefinitely.

Applying to FIRE

Let’s apply this concept to retiring early.

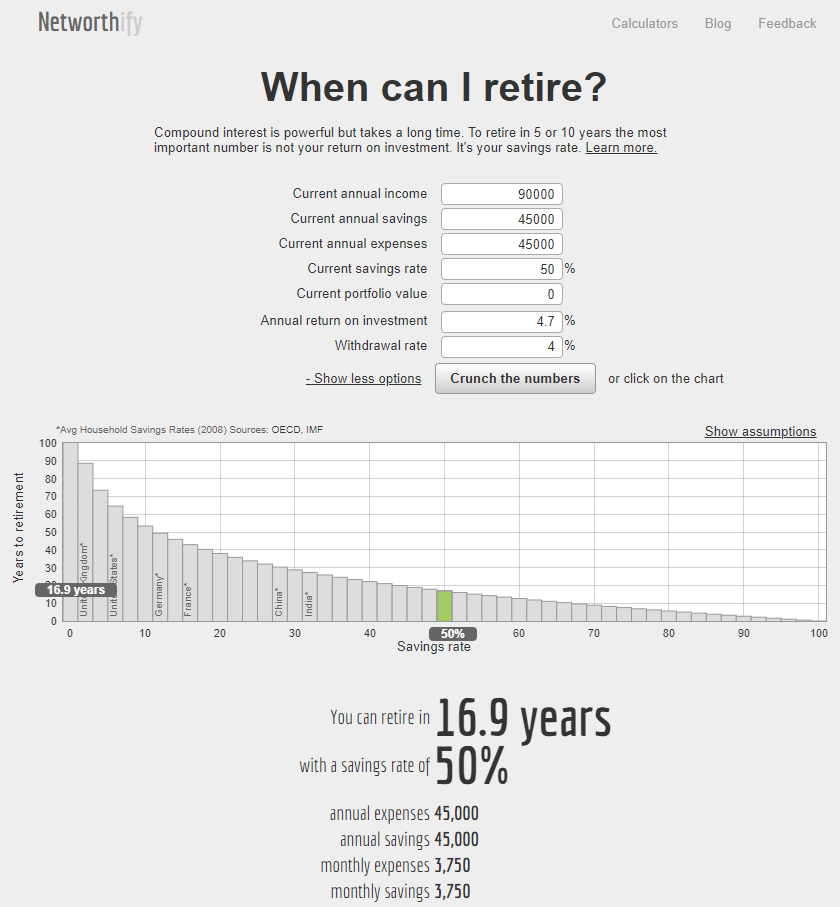

Suppose Tom wants to work until he’s confident he has saved enough to Retire Early without worrying about the future. Tom saves $45,000 (50%) of his $90,000 income each year, and invests all of this money into investments that return 8% per year before inflation. Suppose inflation is 3.3% per the US historical data. This gives us an average annual return of 4.7%.4

Using the excellent calculator over at networthify, we can see that Tom should be able to retire in 16.9 years at this level of saving. Starting on this path at age 35, Tom could reach Financial Independence at the age of 52. He may decide to Retire Early (or FIRE) at the age of 53, seven years before traditional retirement age of 60.

I encourage visiting the site and entering your own numbers to see how to relate this to your situation.

You may have noticed the withdrawal rate value of 4%. This means that Tom will ideally withdraw 4% of his investment portfolio to cover his expenses.5 That is to say, Tom intends for 4% of his portfolio to be worth $45,000 or more each year. Tom’s investments are expected to grow by 4.7% each year, which means that this could work for Tom long term.

As long as Tom is able to predict future expenses and has built a portfolio that will grow to meet those expenses, Tom has reached Financial Independence and has the capacity to Retire Early.

This scenario is simplified to provide a proof of concept for retiring early. External factors, such as negative returns (especially in the year after retiring early) and increases in expenses can impact outcomes. I will discuss this in future articles in the FIRE series.

The final irrefutable truth reveals itself:

- If your investment portfolio beats inflation, is growing in wealth consistently, and provides you with enough or more than enough to cover your current and future expected living expenses without reducing the total value of your investments, you are Financially Independent and have the ability to Retire Early.

Closing

It’s possible to achieve Financial Independence and Retire Early (or “become FIREd”) by following the two statements below:

- Spend less money than you make by managing spending; and

- Invest the savings to triumph over entropy and inflation.

This article was written to develop the foundational knowledge as to why the above statements are true. The irrefutable truths were built upon the logic presented in this article, and serve as the framework that supports the two ending statements.

That’s why this piece doesn’t include any concrete statements. I won’t tell you that a particular withdrawal rate percentage is safe. Nor will I tell you that buying a particular asset is best for your portfolio. These topics are constantly changing, and I think the underlying principles matter more than the information itself.

Is it complicated? Yes. But so is figuring out how to make money in retirement due to inadequate planning earlier in life.

I am writing the FIRE Series as an attempt to create timeless information. I don’t want to write sensationalist or clickbait articles about hot topics. My intention is to build a resource of helpful articles that give people the tools to make solid financial decisions.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.

- There are many variations of FIRE which I won’t go into in this article. ↩︎

- The examples in this article ignore three concepts we’ll discuss in detail later: employer retirement account contributions, investment returns, and inflation. This is a foundational example for explaining the importance of saving. ↩︎

- As above, this example also does not include inflation or investment returns. ↩︎

- This is simplified and may not be entirely accurate, due to varied investment returns and inflation rates in different years. As with everything in this article, this is a foundational concept and used as a baseline from which to build further information upon. ↩︎

- A safe withdrawal rate of 4% is often deemed to be sufficient. The research referred to as the “Trinity Study” found that a 4% withdrawal was almost always successful in a portfolio comprised of 60% stocks/ 40% bonds over a thirty year period. Safe withdrawal rates will be discussed further during my FIRE series. ↩︎