Interest – or the money charged for the privilege to borrow money – is everywhere in our society. Interest is paid on all types of financial products, from savings account deposits to credit card loans. And almost all of them are affected by compound interest.

In order to begin saving and pull yourself out of a poor financial situation, you must understand how compound interest works. If you don’t, it becomes easy to make bad decisions that keep you trapped in the system that enslaves you.

Once you do begin to save, you’ll find your wealth increasing at a rate you never thought possible.

Welcome to another article in the Saving Series – my thoughts on why saving more and spending less pulls us out of poor financial circumstances.

This article focuses on compound interest- one of the most important topics in personal finance. Compound interest will either move you forward or hold you back – depending on how you use it.

What is Compound Interest?

I mentioned earlier that interest is the cost of borrowing money. If you use a credit card to buy something in advance, you can be charged interest on the amount you spent. Alternatively, you can receive interest payments for putting your money in a bank account.

There are two methods for calculating the amount of interest payable: simple interest, and compound interest.

Simple Interest

Simple interest is calculated based on the starting value of the loan. This is common for car loans and other consumer loans.

The amount of simple interest is determined at the start of a borrowing agreement. That interest is then paid each payment cycle (along with the principal value borrowed) until the loan is fully paid off.

The formula for calculating simple interest is, well, fairly simple:

Simple interest payable = P x r x n, where:

- P = principal

- r = interest rate (e.g. 5% would be 0.05)

- n = number of years

Example

Say you finance a car purchase with a $30,000 (P) loan at 5% (r) per annum simple interest rate1. Let’s also say that the loan will be paid off over 6 (n) years, with payments made monthly.

Here’s what our equation above looks like:

Simple interest = 30,000 x 0.05 x 12

30,000 x 0.05 x 12 = $9000 simple interest

The total amount payable would therefore be $39,000 (principal plus interest), split over 60 equal payments (5 years of 12 monthly payments).

To get the monthly repayment amount, divide $39,000 by 60 (5 years of monthly repayments) to get $650 per month for five years.

A simple interest calculation will take into consideration the life of the loan and the interest rate to determine the total repayment amount. The interest paid does not influence the calculation of future months or affect any future outcomes.

Compound Interest

Compound interest is a method of calculating loans that allows the interest charged to impact future calculations. The future interest paid also becomes part of the balance of the loan, that is then used to calculate future interest payable.

Compound interest is essentially interest charged on interest. The longer the life of the loan, the more that the interest can accumulate on itself over time.

A formula for calculating compound interest is as follows2:

Compound interest = P x (1+ r)n – P, where:

- P = principal

- r = interest rate

- n = number of years

Example

Let’s use the same example as above: a $30,000 loan at 5% per annum compound interest, payable over 6 years with monthly repayments. Our formula would look like this:

Compound interest = 30,000 x (1 + 0.05)6 – 30,000

30,000 x (1 + 0.05)6 – 30,000 = $10,202.87 compound interest

The total amount payable in this example would be $40,202.87, which comes out to $670 per month for five years.

The same scenario when factoring compounding into the outcome results in $1,200 more being paid in interest. This is about 11% more interest paid than the simple interest scenario.

The interest paid on top of interest may not seem like a lot at first, but this can dramatically alter your financial outcomes.

Alternative Scenarios

In some cases, making additional or larger repayments of the principal balance can also result in lowered repayments. This depends on the loan agreement and when compounding is applied.

The example above doesn’t include this, but it is commonly applied to mortgages through the use of offset accounts or redraw. This was a basic example, but many loans (like mortgages) compound and calculate interest daily.

Compound interest plays a big role in a few areas of our lives, and its impact can be minor or massive depending on your situation.

The Double-Edged Sword

Compound interest is a powerful tool. When working in your favour, it allows you to triumph over entropy and inflation. When working against you, it will seek to deprive you of as much wealth as possible.

Here’s how both sides of this work.

Exponential Gains

If you are able to save consistently, your money will continue to grow exponentially.

With a high enough interest rate and enough time, it’s possible for your money to grow by more than what you put in.

Even the money in your savings account compounds. You don’t have to invest it to benefit it from compounding.

The money in your savings accounts is effectively “on loan” to the bank, who pay you a fee (interest) to keep that money in your account. They then use that money to fund mortgages or other investments the bank makes.

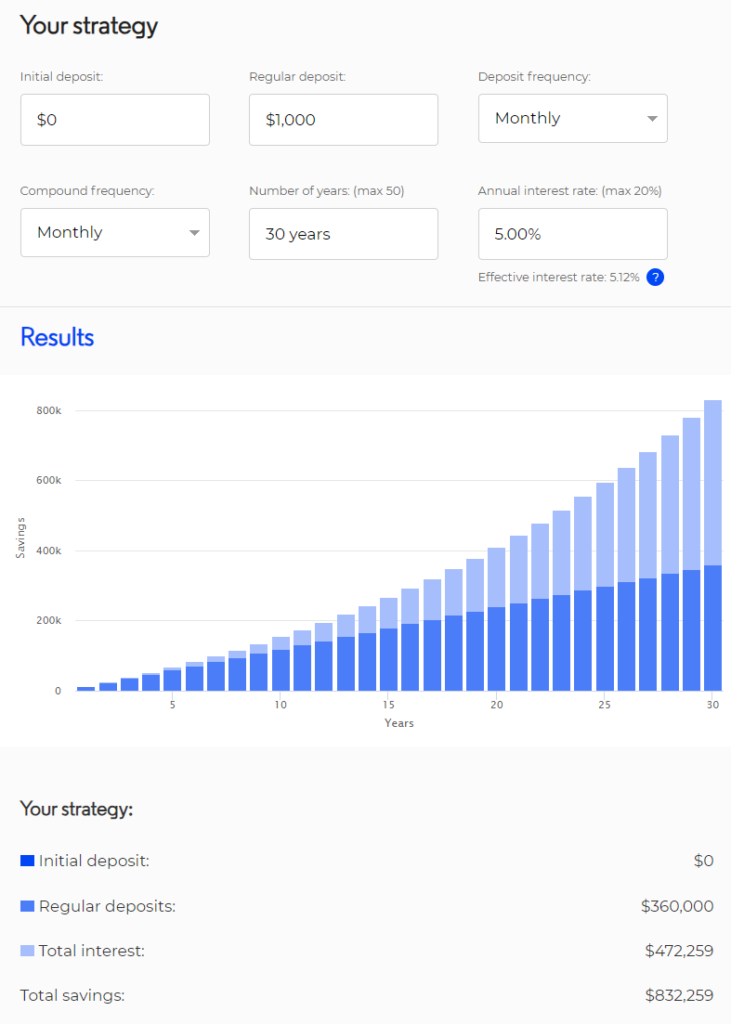

Say you contribute $1,000 a month into a savings account every month for 30 years. The savings account has a 5% interest rate. Over a thirty year time frame, you’ll end up earning more in interest than you contributed yourself:

Compounding your money over time is the secret to long term wealth. If you can allow your money to grow as soon as possible, for as long as possible, it’s easy for that money to grow to more than you could ever need.

It goes without saying that the reverse is also true.

The Debt Trap & Exponential Losses

Just as compounding can be used for your benefit, it can also be used against you.

If your debts pile up too high, you can very easily be trapped in a prison of debt.

Once you’re in it, it’s very difficult to escape.

Credit cards are the primary method through which compound interest is weaponised. Ongoing fees and high interest rates create situations where you barely pay off any of the principal value, especially when only making minimum payments.

In many cases, the low minimum payment and generous time periods offered to carry a balance can result in multiples of the principle amount being paid.

Bills and unpaid debts will also balloon out of control if not managed. This has to be avoided at all costs, or you will be trapped under inescapable levels of debt.

And our society makes it very easy to fall into the debt trap.

Master Compound Interest

Here are a few ways that you can use compound interest to your advantage:

Avoid Consumer Debt

Consumer debt, like personal loans and credit cards, pull your finances in the wrong direction.

The interest rates on these products is massive, delaying your savings goals and creating a problem you need to resolve in the future.

Sometimes it is necessary to take on debt. But it should never be a long-term goal to maintain consumer debt.

Save Diligently

Ensure you are always saving some money for your future.

It’s a non-negotiable step to a better life, especially if you plan to retire early.

Whether it’s by reducing your consumption or finding ways to make more money, consistent saving is a must.

Use a High Interest Savings Account

Banks are generally a safe place to keep your money. Certain bank accounts often come with high interest rates, and it can be worthwhile to find a good interest rate for your savings.

The higher the interest on your savings, the more money you earn and the faster your savings grow in dollar terms3.

Be Patient

Compounding takes time. You need the plant the seeds and wait for them to grow in order to enjoy the full benefits of compounding.

Understanding compound interest isn’t a cheat code to get rich quick. It’s essential knowledge to take advantage of as early as possible, so that your future financial decisions are better.

Closing

Compound interest is a double-edged sword. If used carefully, it can propel your finances forward. When used poorly, it will drag you down and undo years of financial progress.

If you want to make the most of compound interest, you need to be sure you’re generating a profit, then use those profits to invest in your future.

I hope that some of this is useful and helps you avoid being on the wrong side of compound interest.

Thank you for reading.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.

- This is an example and not a recommendation for getting a car loan. The numbers used are not indicative of what you could get on a car loan. You may also find that your dealership/ loan provider only offers loans using compound interest calculations. ↩︎

- This is a simplified formula and doesn’t include extra compounding periods. You may see other formulas online that offer more than this – this is an introductory formula! ↩︎

- Inflation and taxes can erode the value of your savings, but this is the price to pay for storing capital in cash. ↩︎