I was recently chatting to a friend of mine who wanted to learn more about investing. We’ve had conversations about investing in the past every now and again. But the amount of information available makes it difficult to know where to begin.

I’m sure my friend isn’t the only person struggling to figure out how to invest and grow their wealth.

To help them out, I wanted to write down my thoughts on how to get started investing. It’s my hope that I can help my friend (and perhaps you) with navigating the early stages of investing.

I’ve spent several years reading and consuming financial content. While I’m not an expert (and not qualified to give financial advice), I do feel equipped to talk about it. I won’t be telling you “Invest in this asset class” or “invest in that company” though. I will never give direct financial advice.

However, I can talk about how you can learn about investing for yourself, and why you should want to. This includes how to do your own research and make your own financial decisions.

While writing this post I quickly realised that I have a lot more to say than I initially thought. As a result, I’ll be addressing my thoughts on investing in multiple posts. I am calling this the Investing Series.

The goal of this post is to leave you with the following information:

- You know what investing is; and

- You understand the importance of investing as a general concept.

Over time, I’ll expand on these concepts to show you everything I know about getting started with investing.

What is Investing and why do you want to do it?

I describe investing as “committing inputs of time, money, or energy in hopes of receiving a specific, greater output”. Put simply, you spend time or money to get or do something, and you hope that that something either grows in value or returns more than what it cost.

Investing is not a guarantee of any return. Investing is merely a hope that by committing some type of resource, you will receive the output you desire. In some cases, investing can fail entirely, resulting in a waste of time or complete loss of your money.

Despite the risk of losing your investment, I believe that investing is better than not making an investment at all. The reason why I believe this is true is due to entropy and inflation.

Entropy

I describe entropy as “the increase in disorder across the universe over time”. As time passes, energy is being consumed all over the universe in massive explosions and atomic reactions. A lot of it isn’t being utilised for any perceivable purpose and in some cases, is wasted entirely. Eventually the sun will burn out, and our planet will be left without its primary source of light and energy (or burnt up in the process). Chance of survival: low to zero.

On Earth, we see entropy playing out in our day to day lives. Illnesses and ailments affect us with increasing frequency as we age. Surgeries, medicines, and supplements can help to extend life, but eventually our bodies will fail. Time will continue moving forward until eventually we are unable to continue travelling with it.

You can apply this to your skill set, mental & physical ability, and mood as well. Consider practice, logic puzzles and exercise as means of maintaining these traits rather than medicines. As time passes without regular upkeep on these traits, you will find that abilities you once held become difficult or even impossible.

To summarise – entropy means that things get more unstable or over time without inputs to restabilise them. On a human level, your life will get more difficult as time passes.

Inflation

I describe inflation as “the devaluation of a currency as more currency is created”. In most developed countries around the world, a country’s currency is controlled by a Central Bank. The Central Bank is responsible for “minting” new money – that is, adding new money to the economy and increasing the money supply.

There are many reasons this is done which I won’t cover in this post. Instead, I want to focus on the side effect of inflation – the new money devalues all money in the economy upon creation. This can be difficult to understand, so I’ve created a scenario to explain the concept further.

Money Supply in an Economy

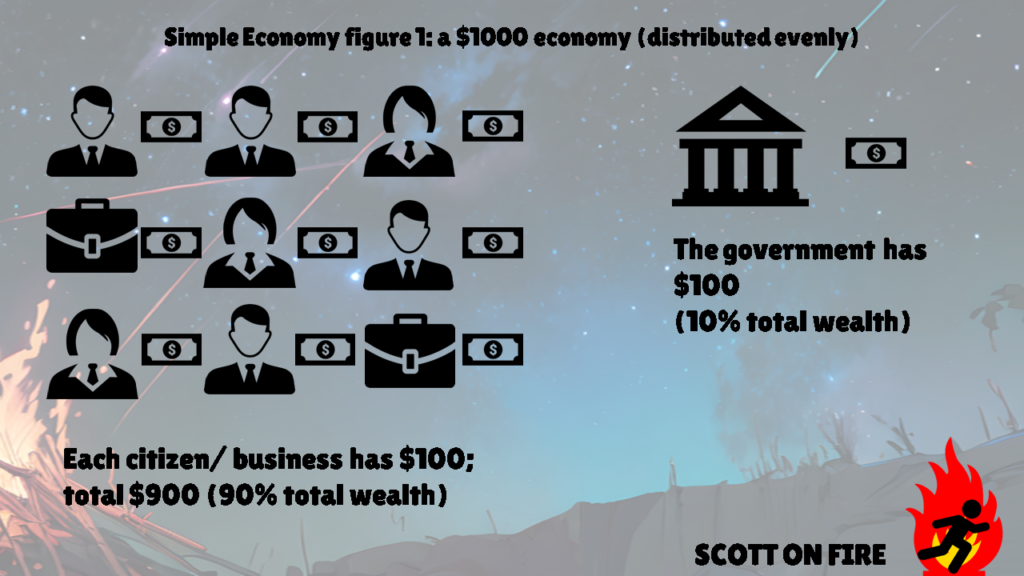

Suppose we have a country with an economy of nine people/ businesses, plus the government. That is, instead of a country having millions of people, this country has 7 residents, plus 2 business, plus the government (a total of ten). Each entity has $100, so the total size of the money supply is $1,000. Each entity has a 10% ownership over all of the money in the system.

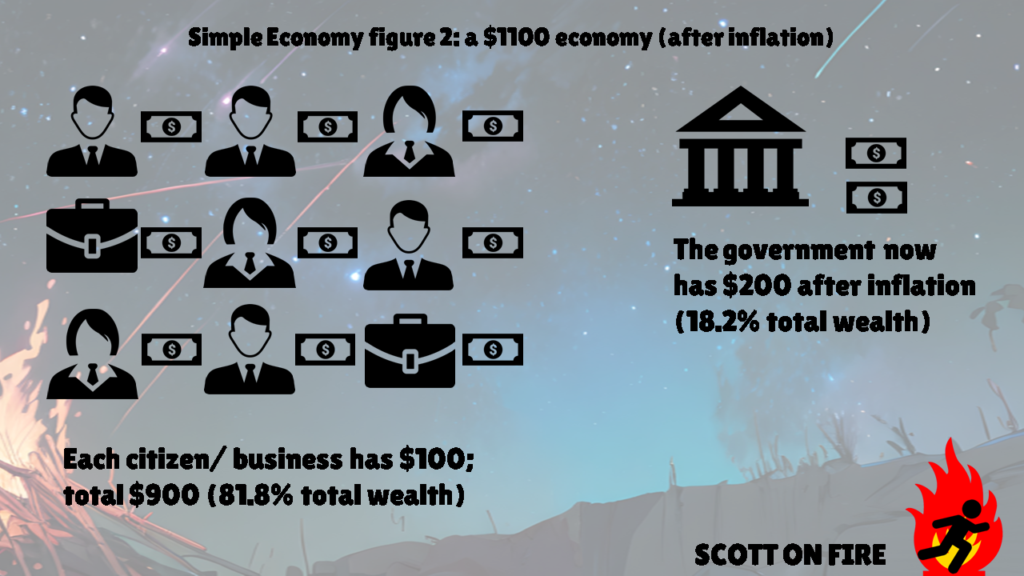

Then, suppose that the government decides its needs more funds to support upcoming projects. Through the Central Bank, it decides to print $100 and disperse this into the economy through government spending1. Now, our scenario looks like this:

The money supply has inflated by $100, or 10%, with that $100 going to the government’s coffers. As a result, each person in the economy (except the government) has a lower percentage ownership of the total money in the system. They are worse off due to each dollar being worth a smaller percentage of the total economy.

The value of each dollar decreasing impacts business decisions too. Businesses may demand the same sized slice of the economy per sale. As a result, they will raise their prices proportionate to the inflation amount. As our example economy had 10% inflation, businesses might raise their prices by 10% to ensure that their goods are selling for the same total value as before. An item that sold for $10 before would now sell for $11.

Therefore, the people in the economy are worse off due to each dollar now being able to purchase less goods and services.

Back to Reality

Let’s apply inflation to the real world. When money is printed, there are two direct impacts:

- The value of your money (as a percentage of the whole economy) decreases; and

- The amount of things you can buy with your money decreases.

To summarise – inflation means that your money is losing value over time. Broadly speaking, if your finances are based solely on currency, your financial situation is entropic by nature (doomed to get more unstable over time).

What does any of that have to do with investing?

That was a lot of words spent not talking about investing. But I think it’s valuable to talk about why investing is important in the first place.

Almost everything you do is an investment. You’re committing your time, energy, or money into something that you hope delivers a reward. That could be a monetary return, a feeling, or another benefit. As humans, we usually put our investments towards things that we believe will give the most positive results.

The goal of investing is to receive an output that’s greater than the inputs you applied to it. This output could be something financial, like a cash dividend payment, or capital gains from the sale of an asset that increased in price. Or it could be intangible, like a prolonged life due to maintaining good health. You cannot say for certain how many years you have left to live, but the value of your health is priceless.

Consider your job as an investment; you invest time and resources in getting to your workplace, and you invest time to complete the work assigned to you. In return for your investment, you are paid a wage.

But how do you know what a good Return On Investment (ROI) is? Let’s talk about entropy and inflation again.

Investing vs Entropy & Inflation

As discussed earlier, your body and your money are both doomed to get weaker and more unstable over time, unless you actively attempt to change that. I do not need to explain that this is bad.

Therefore, ideal investing goals are those that at the very least, attempt to overcome entropy and inflation. You could argue that a good ROI would be anything that makes your money situation better, or something that makes you “feel” better (in body or mind).

Putting your money in a government-secured bank account will likely return a small amount of interest for minimal risk. This will help protect against inflation (but not entirely) and gives peace of mind that your money is safe. Even if the interest earned is less than inflation, the security could make it a good ROI for you.

A job would also have a good ROI. We need money to survive in society, so the value of the first money you earn from your job has a high ROI. If your needs and wants are already met, you may find that working additional hours for more money has a lower ROI and is not worth it. An investment can become a bad deal in certain amounts.

Feeling prestigious while wearing luxury new fashion brands counts as a return on investment, too. You’re trading your money (often derived from your time working) for that feeling of prestige. That said, this feeling ranks low for me, so I would never consider this for myself. Everyone is different and has different investing goals.

ROI on Non-Monetary Investments

Moving away from money, logic suggests that having a healthy body would therefore be a good ROI for your time spent working out. So too is the enjoyment derived from playing video games or visiting friends.

Some investments you make will have better ROI than others, and often that will be outside of your control. Market forces, luck, your location, and any number of other factors can influence any part of your life or your investments.

But actively choosing to invest time and money into improving your personal and financial situation is the best way to stave off both entropy and inflation.

By investing time into your financial education and learning about investing, you are taking the first steps towards triumphing over both entropy and inflation.

Closing

This piece took a much different direction than I initially thought it would. But I’m happy with the result.

Investing is more than just financial. Every decision, every action you take – intentional or otherwise – is an investment towards the life that you want to live.

I wanted to talk about what investing means to me as a concept before discussing the world of financial investments.

I also want to thank you for reading, especially while I work to find my written voice. It’s been several years since I have shared my writing publicly. It’s also the first time in a long time that I have written purely for the sake of writing.

In the second instalment of the Investing Series, we will discuss what makes a good investment. We’ll also talk about different investment types, as well as how to determine if an investment is worth it to you. Check it out below.

Next: Investing Series Part II – What Is a Good Investment?

I hope you are as invested in reading the future entries in this series as I am in writing them.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.

- The actual mechanics of money enters the money supply vary slightly across countries. This is an extremely simple example of how money could enter an economy. ↩︎