A common thought in our society is that one should earn as much money as possible as soon as possible. I propose a different strategy: earn enough, but no more.

By understanding how much money is required to meet your needs, you can pursue work that meets those needs. This also includes your future financial goals, which you can (and should) build into your strategy.

Focusing simply on making as much money as possible is — in my eyes — putting the cart before the horse.

Welcome to the Work Series — my thoughts on how we can leverage our past actions to earn as much as we need while working as little as we want.

The Dangers of Focusing on Income

Earning a high wage is extremely important. Not only does it give you financial security in the form of increased cash flow, but it means you are more likely to be able to save and invest that money.

Perhaps you are working towards financial independence. If so, then compounding suggests earning as much money as possible as early as possible is an ideal strategy. Of course, every strategy has downsides. For some, the sacrifice of working hard during your prime years may be too much to bear.

Alternatively, you may be trapped in the cycle of spending that necessitates a higher income. If you fall in this category, then saving is a much more important goal than altering your work strategy.

Both of these scenarios have problems. In the case of the investor, their goal is to maximise income as early as possible to achieve financial independence and never work again. To the spender, their goal is also to maximise income in order to fund their excessive spending. The solution to both of their problems is simply more money, and this is a dangerous position to be in.

Focusing on money means that money becomes the only way to solve your problems. In both scenarios, you cannot create your ideal life until you have enough money to do so.

Goals that are intrinsically linked to the amount of money you earn are dangerous. Under these goals, your definition of success becomes tied to making as much money as possible. If you don’t earn the desired amount, your goal dictates that you have failed.

You are much more than your successes or failures in meeting financial goals. And I think there is much more to consider than simply money as part of these goals.

On Financial Goals

The previous section may suggest that I think poorly of setting financial goals. In fact, the opposite is true — setting goals helps you set benchmarks that make sure you earn enough for now and the future. They’re an essential tool for managing your money.

Financial goals allow you to forecast how changes to your financial circumstances influence you later in life. This is mandatory for retirement planning, as well as for those pursuing Financial Independence. Trying to go through life without such a plan is a disaster waiting to happen. In many cases, those without a plan don’t realise their situation until it’s too late to fix it.

My Financial Goal

I have a financial goal of saving and investing enough money to make work optional by the time I’m 40 years old. At the time of writing this, I still have the better part of a decade to achieve this. This is achievable for me if I save approximately half of the income I expect to earn over this timeframe.

Yes, I will be able to achieve this goal if I earn more money. But as I’ve written previously, earning money isn’t my focus anymore. My focus right now is to Choose Work I Love. I know how I want to work, and am happy to sacrifice maximum income in pursuit of that working style.

My personal philosophy can be seen as a story of how a person’s relationship with money changes over time. We start on the saving path, increasing savings while reducing our expenses. We then begin to invest as we gain more free time and money. And we Choose Work We Love once we become mighty enough to do so.

When coming to terms with this idea, I learned that I needed to reconsider how I approached Financial Independence. I then sought out a more sustainable path to achieving it.

Achieving Financial Goals Sooner Than Expected

Questions start to arise when you achieve your financial goals sooner than expected.

Let’s say that a person who was looking to become financially independent at age 55 instead reaches their number1 at age 50. This is a huge accomplishment, and they’re happy that their hard work has paid off.

But then the first question arises: now what?

If a person plans to achieve their financial goal by a certain date and achieves it earlier, then suddenly that plan doesn’t look the same as it did. Half a decade of work is now no longer mandatory. Should they quit their job on the spot and start doing what they love? More importantly, why did they wait until they were 50 years old to do what they love?

Designing the life you want to live after you achieve your financial goals should happen along the journey. Waiting until you achieve your number before taking action is simply putting off the truly difficult prospect — what do I do once I retire? It’s a difficult question, but one that can’t be put off.

Why We Work

I’m not going to beat around the bush — most of us work just to get paid. There aren’t many people who would do what they do for a job for free. Finding meaning, solving problems, and enjoying what you do are secondary factors when we live a life that necessitates earning a salary.

But there are plenty of other benefits to work. For many people, a job provides stability, community, and predictability. It provides a space for you to hone your craft and derive meaning from the work you do. Above all, it allows you to see and feel that the things you do matter.

I think these benefits are overlooked by those pursuing traditional FI. The desire to quit working entirely overrides the thought that certain types of work may actually be enjoyable.

The pursuit of a financial goal, taken to its extreme, can result in you ignoring real life. You end up tolerating work you hate, and continue earning money even if it doesn’t serve a direct purpose.

A single-minded focus on financial goals will distract you from what truly matters: a life well lived, day in and day out.

The solution to this is to understand what is enough for you to live and meet your goals. Earn enough to achieve them, but avoid earning more than you need.

Why Earn Less?

I’ll admit that suggesting one earns less than what they’re capable of is an odd prospect. Despite this, it’s a central component of my personal philosophy, as it allows you to buy back what truly matters: your time and your focus.

For anyone looking to retire early from paid employment, this is already something they consider. The opportunity cost of retiring early is often hundreds of thousands to millions of dollars, depending on your income.

The FIRE community is no stranger to the prospect of leaving money on the table — it’s just not often talked about outside the lens of retiring early. I believe that we can use this to create a life-work balance with the scales tipped in our favour.

How To Earn Enough (Without Earning Too Much)

If a person is looking to earn enough while avoiding earning too much, there are a few steps to consider:

First, you should understand exactly how much money you need in order to sustain your current lifestyle. If you’ve acted upon any of the information elsewhere on the site, such as how to run your life like a business, then you may know this value already. This gives you the absolute bare minimum amount needed to avoid going backwards and allowing entropy to take over.

Second, you should review your financial goal and determine how much you would need to save in order to achieve that goal. This value is best captured in monetary terms rather than a percentage, as you can add it to your first value to understand how much you need to earn. Combining the two goals means that you now understand what you need for your present and future needs.

Third, determine how much time you need to work in order to achieve this amount of money. Ideally, the amount is less than a full-time work week. Knowing how much less you can afford to work without sacrificing your goals allows you to choose how much you want to work. This is also why increasing the value of your time is so important.

Finally, find ways within your occupation to work fewer hours. If you’re a shift worker, you may be able to work fewer shifts. A full-time office worker may be able to work one less day a week. An independent contractor may decide to take on fewer jobs. This may require finding a new role or starting your own business to achieve. I found that this was impossible in my consulting role, so I switched to contracting and a solo business model instead.

If the amount of money you earn is enough, the amount of time and how you work doesn’t matter. The goal is to minimize doing work you don’t want to do and spend more time Choosing Work You Love — whether it pays you or not.

Earning Too Much is a Waste of Time

There’s one last thought I have regarding working more than you need: it’s simply a waste of your time.

Avoiding overwork is a key component of being able to Choose Work You Love. Working too much, and by extension earning too much, is a waste of your time and focus.

Unless you love every moment of every workday, continuing to work as much as possible is illogical and inefficient.

The simplest reason for this is that you are committing yourself to doing things that don’t directly improve your immediate circumstances. Grinding to achieve a far-off goal while suffering in the present is backwards. This is also before you consider entropy and inflation, and the knowledge that frontloading this work means sacrificing prime years of your life.

By creating a strategy to achieve FI and living a lifestyle that allows you to, you have already done the hard work. The goal is achieved once the coordinates are set and the pieces are in motion — all you have to do is ensure you continue to move in the right direction. This often gets dubbed the “boring middle”, but it’s your duty to make it not boring.

The Convenience of Salaries

If you’ve reached the point where your needs are met and excess money is being invested, it’s very easy to continue taking a salary. That savings number will continue to go up. All you need to do is keep turning up to work and smiling at your co-workers while you accumulate wealth.

Salaries are addictive substances that warp how we interact with the world. If we become slaves to our salaries, our wealth will be destroyed, and we become trapped in the system we were trying to escape from.

We continue to invest too much time into our jobs without realizing that we can already buy the freedom we have been seeking. Weaning yourself off a salary, in full or in part, allows you to increase your self-reliance, earn enough, and use your investment returns to create your ideal lifestyle now.

Effective Post-Tax Hourly Rates

There is a bigger financial component to working more than you need – tax.2

Many nations have progressive tax systems, which tax higher income amounts at higher tax rates. As an example, this may mean that your 99,999th dollar is taxed at 30%, but your 100,000th dollar is taxed at 40%. This means that proportionately, the last hours you work in a week will be taxed at a higher rate than the hours you work earlier in the week.

We can see the effect of this using the 2024-25 Australian tax rates.

Let’s say a person earns $400 a day (before tax) and works 5 days a week (earning $2000 per week). This person would pay $464, or 23.6% of that income, as tax. This person would have $1536 remaining, or $307.20 per day worked.

If the same person earned $1600 a week working 4 days a week, they would pay $336, or 21% of their income, as tax. This comes out to $1264 a week, or $316 per day – almost $9 per day higher than if they worked 5 days a week.

Earn Enough By Working Less

This demonstrates that while the total number of dollars you are paid goes down, your effective hourly rate goes up. Maximising your hourly rate maximises your leverage and the efficiency of your time, freeing up your time for other pursuits.

The numbers in this example are small, and the impact of this is larger at higher income and tax brackets. But even $9 a day can become a massive amount over time.

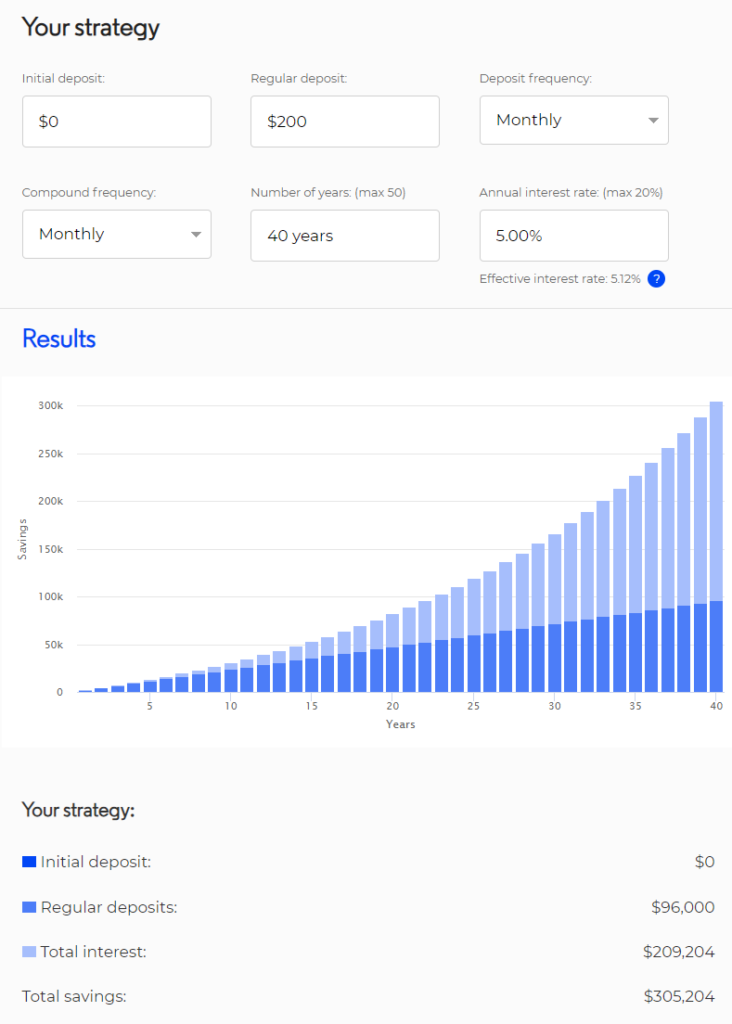

$9 a day is $45 a week, or $200 a month. And $200 invested monthly for 40 years comes out to $300,000 better off in retirement – inflation adjusted.3

Being aware of this allows you to maximize the efficiency of your time while sacrificing as little to tax as possible. It’s up to you to decide what “enough” is – how much money is enough, as well as how much work is enough.

Closing

I believe knowing how to earn enough money, but no more, is a lost art.

I’m not referring to making enough to get by – I’ve discussed the challenges of this at length in my Saving Series. I mean the ability to formulate an investing goal and then manipulate how much you work in order to achieve the desired income.

Maybe you do this by working part-time and picking up extra shifts when needed. You may be a contractor who only works on a project for a few months, then takes a few months off work. There are ways to do this that often get overlooked by the convenience of a salary.

So many of us, myself included, defaulted to getting a regular job for a consistent salary. It’s simple, it’s easy, and highly addictive. But the focus becomes earning enough to solve all of our problems; problems that often arise as a result of excessive work.

Avoiding overwork can only happen if we are in control of our work. Only once we take control of how we work do we gain the ability to truly Choose Work We Love:

Work that allows us to earn enough for our present and future needs, and no more.

Thank you for reading.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.

- I think the core issue is boiling FI down to a number. Achieving FI is simply a marker of money well-invested. A life well-lived is my true goal. ↩︎

- A reminder that finance talk on this blog is general in nature. I know a bit about money, but I’m not a financial advisor. Read more here. ↩︎

- The image shows an interest rate of 5%, which assumes returns of 8% per annum and 3% inflation for a 5% compounding return. ↩︎