As you progress on your investment journey, the threats to your wealth become larger and larger. On this journey, avoiding scams, bad actors, and bad advice are essential.

Avoiding scams isn’t as easy as ignoring everyone and everything and doing things yourself. No matter how much self-reliance you cultivate, you will ultimately need to rely on others for certain things. As a result, you need to know how to engage with others in ways that don’t result in your wealth becoming unravelled.

Welcome to the Investing Series—my thoughts on how you equip yourself with the tools you need to avoid the destruction of your hard-earned wealth.

Identifying Scams

Scams seem to be everywhere nowadays. I feel as though I see a new victim of financial scams on news sites or social media every week. It makes sense why: scams are extremely lucrative, with Australians losing over $2.7 billion to scams in 2023.

This isn’t a recommendation for learning how to scam people. Instead, it’s a warning of the urgency to protect yourself against them.

Too-Good-To-Be-True Opportunities

Sometimes you’ll come across investment opportunities that look fantastic on the surface—guaranteed return, low or no cost, low risk, easy to get your money back.

If an investment ticks all of these boxes, it’s likely that it’s too good to be true.

You need to be able to understand what is a sensible expectation to receive from an investment. If you can’t, then you won’t have the ability to look at these opportunities and see them for the scams that they are.

Either information is being withheld from you, or you are being lied to.

Unusual payments

Some scams rely on the victim doing things outside of the ordinary in order to achieve a positive outcome. Below are a few strange payments that I’ve seen from scams in recent times:

- Gift cards: The victim is instructed to buy gift cards and send the codes to the scammer.

- Direct transfers: The victim sends money directly to a bank account or via a payment platform without buyer protection.

- Cheque bounce scams: The victim receives a dishonourable cheque in the mail from a job or investment provider and is advised to buy specific items, then send a cheque with the rest back. By the time the cheque bounces, the scammer gets away with the cash.

You may be presented with an opportunity that requires you to spend or receive money in a strange way. When you do, do not engage and immediately report this to your local authorities.

Accept that nothing is free

When dealing with other people or businesses, always assume there is a cost. Generally, a person or business will not contact you unless there is a benefit to them for doing so.

This is the same with social media too. People sharing content online want you to see their content. This, in turn, leads to you consuming more of their content or subscribing to their email list and eventually buying their product.

I don’t consider social media marketing to be a scam. I use this myself for bringing attention to this blog. However, it’s important to note that a scammer could use this to acquire leads they can scam.

Your money is but one commodity you hold. You can be scammed out of your time and your attention. Take care to protect these, as you’re likely investing to buy back your time and focus.

Identifying Bad Actors

When it comes to you and your money, bad actors may be found anywhere, from a financial advisor to a member of your own family. You may encounter those who wish to deprive you of your assets in a way that benefits them.

You must, therefore, understand how this is possible and how to avoid it at all costs.

Financial Advisors and Percentage-Based Fees

You’ve worked for many years and built up an investment portfolio that will ideally provide for you throughout retirement. Protecting this should be an extremely high priority.

Don’t outsource decision-making around how best to utilize your money to others; take ownership of that yourself.

You must have a baseline understanding of how investing works. If you don’t, you risk falling victim to professionals who do and want to take advantage of you.

An extremely common method used by financial advisors is to sign you up for investment products that operate with a high Management Expense Ratio (MER). The MER is a fee deducted from the value of your investment daily. A tiny slice is taken from your portfolio value each day, to align with a yearly MER % rate advised to you.

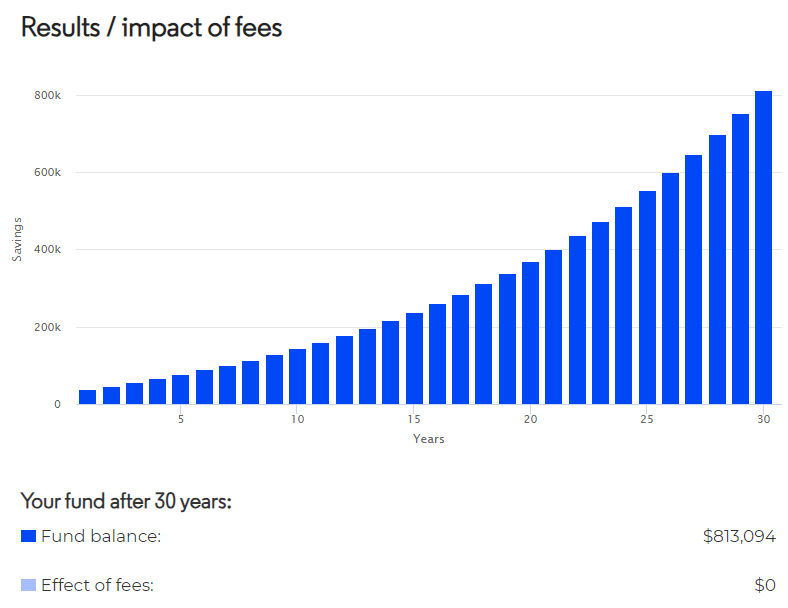

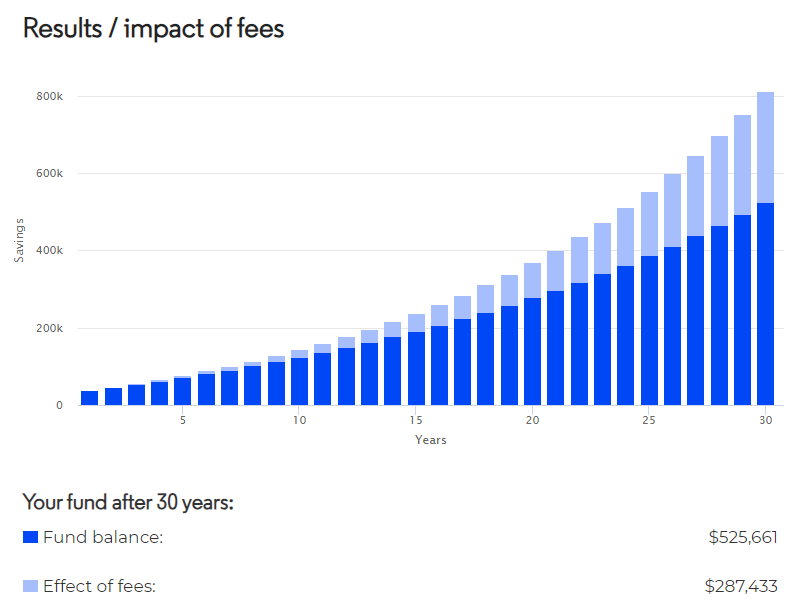

Picture this: You have $30,000, and you go to a financial advisor to invest this, plus an additional $500 every month for the next 30 years. The advisor recommends you place that money in one of their investment products. Let’s also say the product they advise has an average 7% return per year and has a Management Expense Ratio of 2%. Sounds reasonable, right?

Wrong.

Impact of Fees

If you invested that money yourself and were able to achieve a 7% return year over year, your portfolio would be worth $813,094—a sizable portion of money for only investing $500 a month. And 2% of that number seems pretty reasonable, doesn’t it? $17,000 to secure an $800,000 portfolio in retirement?

But that’s not how it works.

This same investment strategy, with a 2% management cost per year, would result in you being worse off by $287,433. That 2% is sliced off your portfolio’s balance every single year. The value removed from your portfolio also loses the benefit of compounding, ultimately costing you over a third of your portfolio’s balance.

I personally believe that most people don’t need a financial advisor. The information we need to create a simple, diversified, low-cost investment portfolio is widely available on the internet. And this investment portfolio structure seems to serve most people’s simple need to preserve and grow wealth.

There are, however, several reasons why visiting a financial advisor is a good idea. Perhaps you have a complicated investment portfolio that you need to optimize, or you operate a trust, or have several investment properties. There are plenty of reasons, and this list isn’t exhaustive. There’s nothing wrong with seeing a financial advisor for advice if you can’t find what you’re looking for online.

If you’re just starting out with investing, take time to understand what it costs to maintain a diversified, low-risk investment portfolio before you see a financial advisor. Whether you choose to pay an upfront fee for advice or trailing percentage fees, do the calculations before you enter the lion’s den.

Complicated Investment Strategies

Another common scheme used by investment firms is to offer you complicated investment strategies. These are peddled as highly lucrative investments, with the details of how the money is to be made obfuscated from the investor. The intent is for you to trust that they will deliver the return on the capital that they say they can.

The problem with this is twofold. Firstly, the bad actor can make that investment strategy appear sophisticated to attract investment into it. Secondly, by keeping the details vague, they ensure that investors cannot replicate the strategy themselves.

Investments in this category usually sit highly on the risk-reward spectrum. Often, the risks of the investment don’t get fully explained. However, its rewards will be.

I’m strongly against investing in anything that I don’t understand. I think the basis of any strong investment portfolio is your understanding of how each of your investments operates.

Again, preliminary research here is crucial. If you don’t have any basic investing knowledge to rely upon, these professionals will run rings around you. Since we’re dealing with your livelihood, your future, and the future of your family and dependents, you must do the work yourself.

Familiar Threats

I’ve mainly talked about bad actors from a professional context, but you’ll also find bad actors closer to home.

When on the investing journey, you’ll likely accumulate wealth faster than your family and friends. If this is your situation, you may find yourself with a target on your back.

There may be those in your life who wish to strip you of your wealth. This could be a friend who always forgets their wallet when you go out to dinner or a sibling who thinks you deserve less from your parents’ will because you earn more money than they do.

Threats to your wealth, both present and future, will come in all shapes and sizes. How you deal with them is up to you. Perhaps you are happy supporting a friend with dinner every now and again; your friendship may be worth more than a meal. Other threats must be fought much more ruthlessly.

There isn’t too much more to say about this one. It’s unique to every person, every relationship, and every friendship. Just be aware of how the people in your life interact with you based on their understanding of your wealth.

Identifying Bad Advice

It’s not just bad actors that you have to watch out for. You also have to consider that the people who have your best interests at heart may simply be giving you bad information. Bad advice can take many forms, from bad investment calls to tax optimisation strategies.

Whether it’s from a professional or a trusted member of your family, misguided information can have devastating consequences on your finances and future wealth prospects.

There’s only one real way to identify bad advice: you have to know that it’s bad advice.

Do Your Research

I mentioned it above, and I’ll mention it again: you have to do the research necessary to understand what’s the best outcome for you. You can pay for financial advice or talk to family members as much as you want, but all this will do is fill your head with noise about the potential options you can make.

You have to take the time to research what it is you truly want to achieve in order to create a solution for achieving it.

Get Second Opinions

Second opinions are important when dealing with professionals. If your financial or personal situation is complicated and you need professional advice, it makes sense to source that advice from two or more parties. Doing this gives you multiple independent perspectives regarding your situation.

These perspectives will also provide insights into how different professionals aim to solve your problems. This could include costs, fees, possible rewards, and ongoing effects of following their advice.

In any case, having multiple sets of information to review allows you to determine the quality of each set of information.

This also serves double duty in weeding out possible scams or bad actors, as you may find that certain information you receive does not have your best interests at heart.

Closing

You are the only person that cares about your financial well-being. Everyone else just cares about your finances – and what those finances can offer them.

Avoiding scams is one of the most important things you can do to protect your wealth in the future.

Your money, time, and attention are the primary commodities that can be scammed from you. You must do everything in your power to protect all three of these commodities.

Protecting them allows you to maximize the amount you preserve for your future. If you preserve and invest enough money, you will be able to use your time and attention as you please. The extent to which you do this changes the result.

If pursued to the extreme, your investments will give you the freedom to Retire Early.

If your strategy is to live a life you love right now, this will allow you to Choose Work You Love.

Whichever strategy you choose, avoiding scams is a necessary step to make the life you want possible.

Thank you for reading.

If you liked this piece, consider sharing it with a friend or a group you think will enjoy it.

If you’d like more content, check out previous posts on the blog or my YouTube channel. For social media, follow me on X @ScottOnFire, and on my Facebook page Scott On Fire. You can also sign up to my newsletter to get even more content, delivered straight to your inbox.